February 5, 2026

After years of sustained economic volatility, the consumer packaged goods (CPG) industry stands at a clear inflection point. To thrive in this environment, CPG brands must move beyond traditional loyalty models and adopt a new playbook focused on delivering consistent and compelling value to today’s shoppers.

In our third annual report, we surveyed more than 5,000 U.S. grocery shoppers with a goal of shedding light on the current and future state of consumer spend in 2026. Our findings reveal evolving consumer spending behaviors that require CPG marketers to be more thoughtful and dynamic in their strategies than ever before.

The rise of the insulated consumer

No longer in "crisis mode," the American shopper has entered a new normal, one where flexible routines and pragmatic, value-centric behaviors have better insulated them from the day-to-day anxieties of inflation.

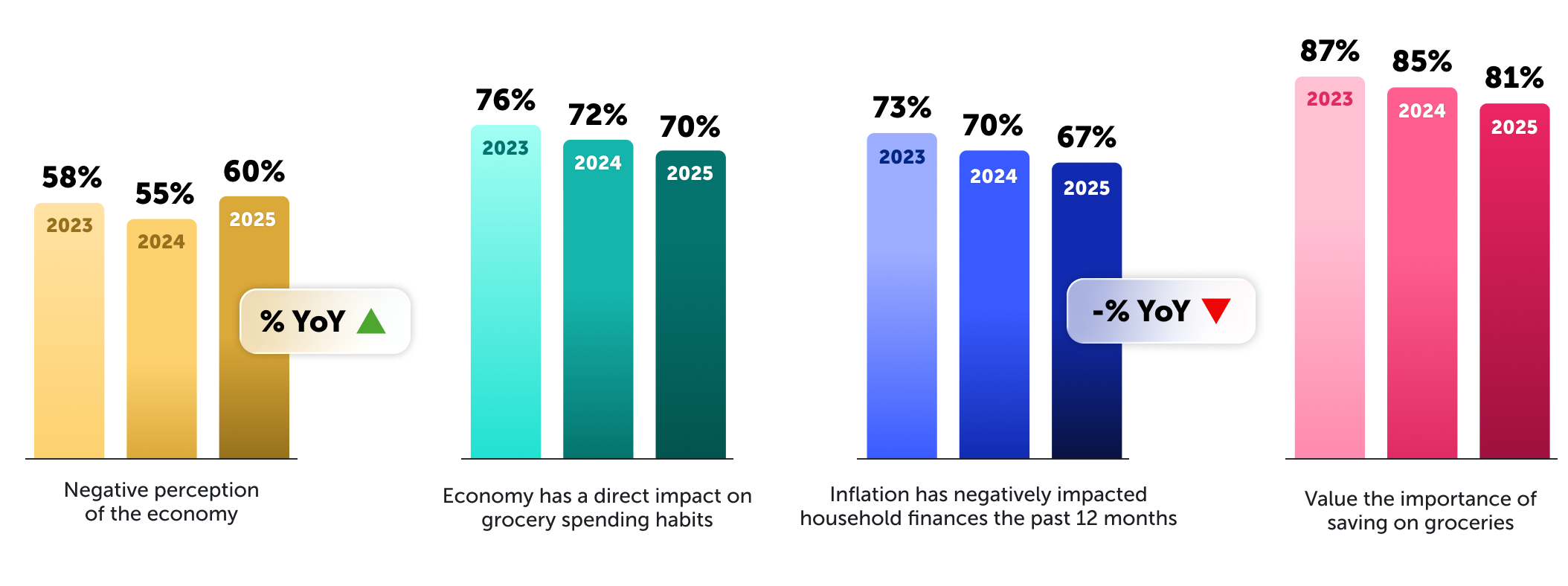

In previous years, consumer perceptions of the economy and its impact on their personal finances have gone hand in hand, a symptom of rising prices and diminishing buying power in the grocery aisle. But this year we’re seeing a shift, and it’s having a notable effect on how and where consumers shop.

Despite an increase in economic pessimism, fewer consumers reported feeling the effects of economic conditions on their household finances, spending habits, and need to save on groceries. These numbers suggest that behavioral adaptations — like switching stores or brands and seeking out deals — have become increasingly routine. By establishing these new habits, consumers have shielded themselves from economic headwinds and, as a result, feel more in control of their personal budgets.

This isn’t to say that grocery costs aren’t still a concern — 67% of consumers surveyed still acknowledge the negative impact of inflation on their household finances. Rather, it provides important context for the spending habits we’ll explore throughout this report.

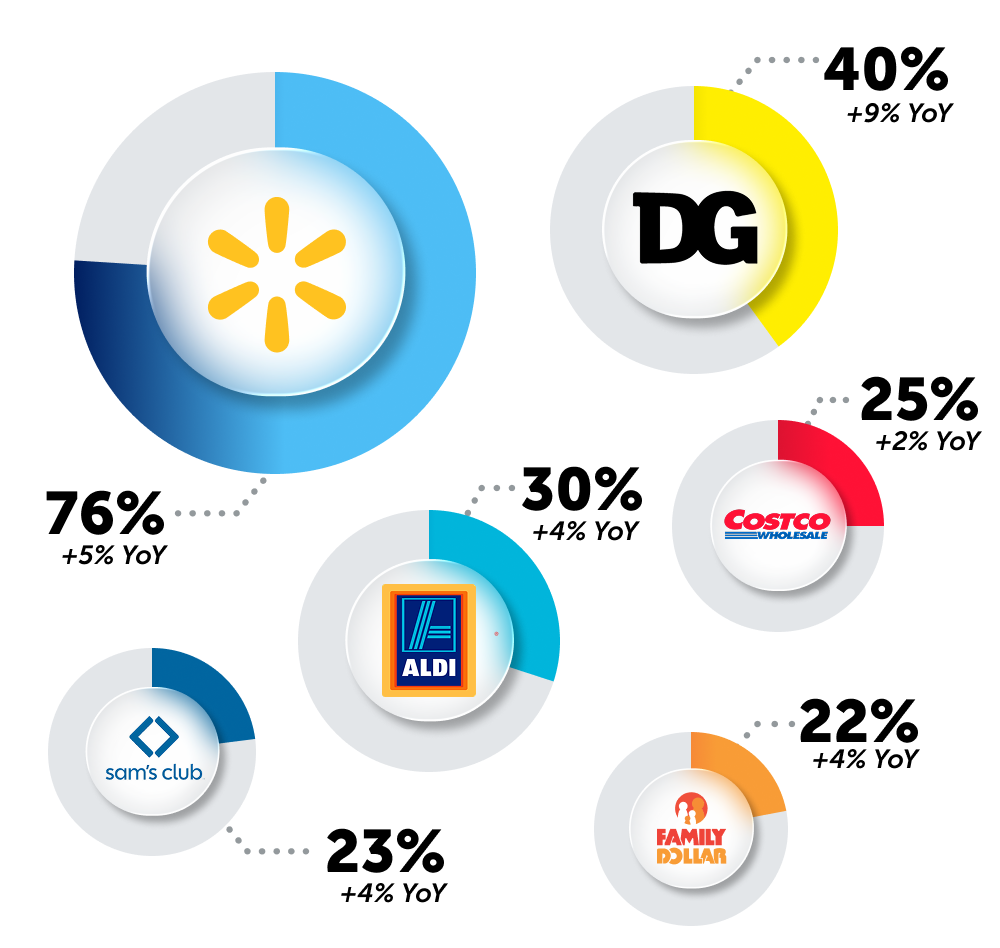

This defensive playbook manifests in two key ways: a shift toward value-focused retailers like Walmart and Dollar General and a growing de-prioritization of brand names.

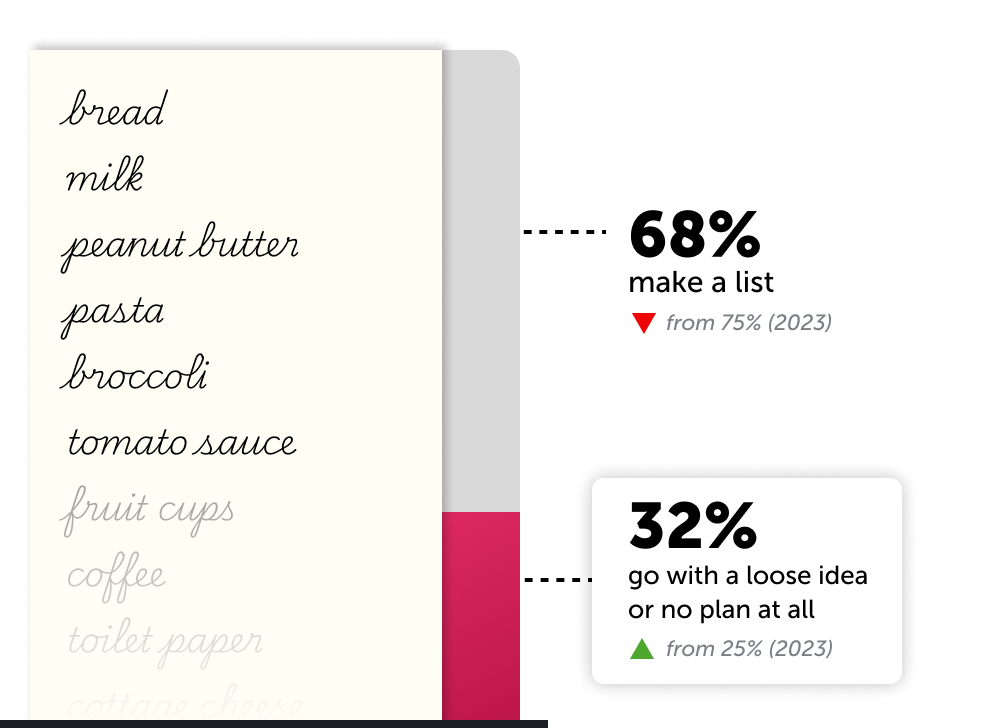

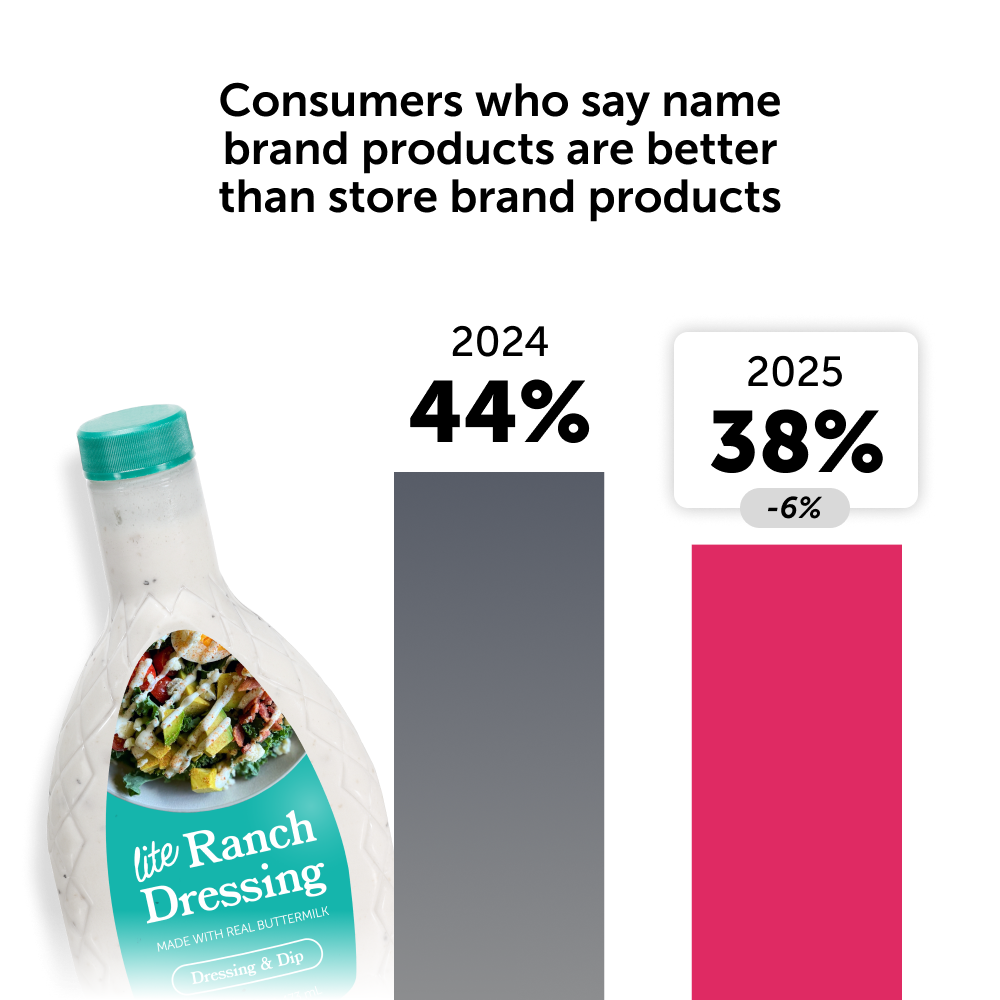

This price-first mindset has driven a continued increase in private label purchases, as the perception of quality closes the gap with national brands. It has also led to less reliance on pre-planned grocery lists, giving way to a flexible, opportunistic shopper who leverages in-store sales and promotions as a strategic trade-off.

For CPGs, the message is clear: the battle for the cart is fiercer than ever. With 74% of the cart anchored by habitual purchases, successful trial — often requiring a discount of 25% or more in key categories like food — is the essential cost of driving meaningful shifts in sales. Furthermore, digital promotions have become a foundational value layer, with 56% of shoppers now expecting brands to offer digital coupons and cash back as a standard part of the shopping experience.

As we dive deeper into these trends, we’ll give brands their own playbook for navigating this new normal with confidence.

Reimagining the grocery list: From rigid plans to flexible opportunism

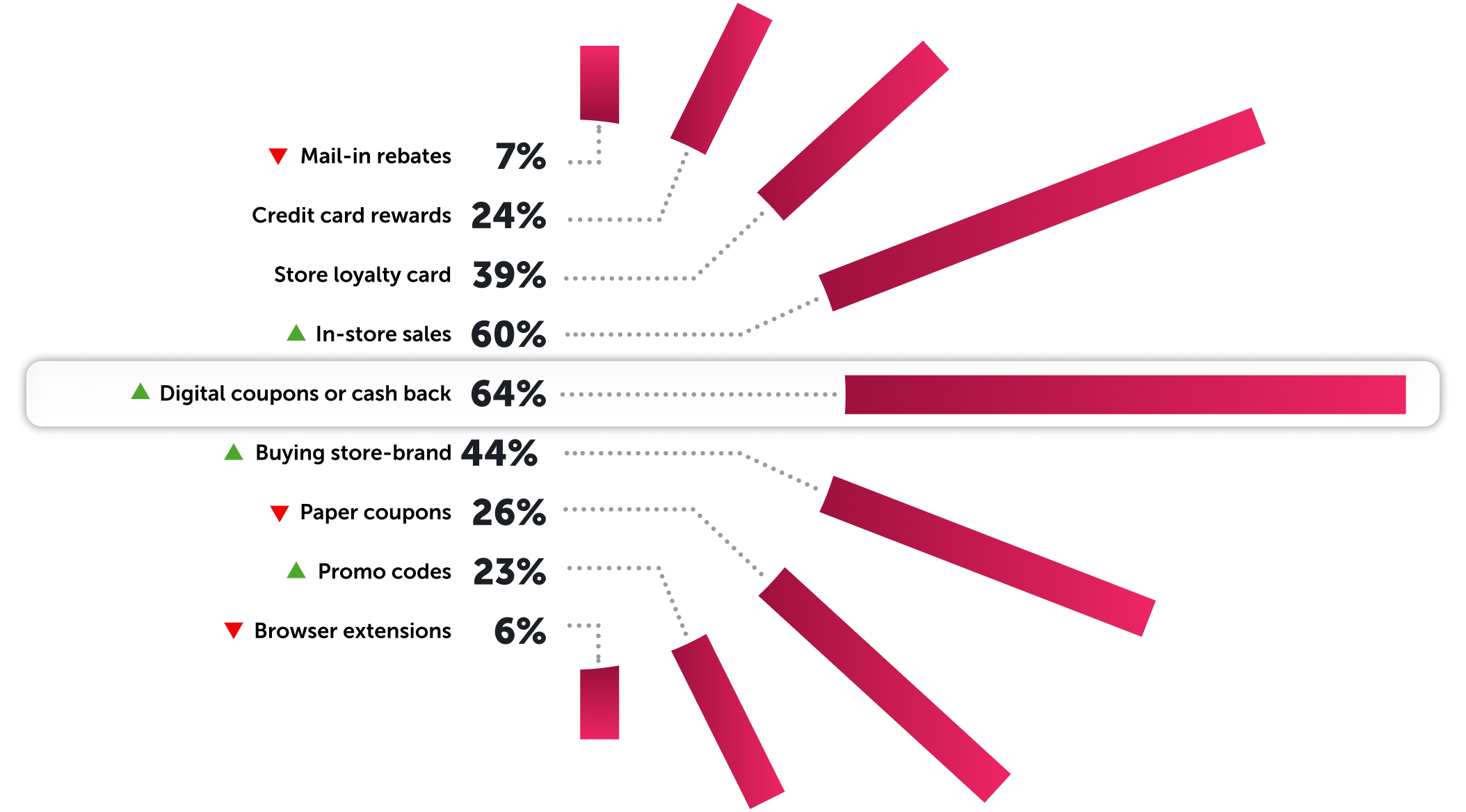

This proves out when we look at the most common ways consumers are saving on groceries right now. In-store sales saw the biggest year-over-year increase in use as a savings method, up to 60% from 55% the year prior. Once again though, digital coupons and cash back remain the most commonly used savings tactics, utilized by 64% of shoppers.

The battle for the 26%: Breaking into the habitual cart

However, this represents an opportunity for brands too, as a successful trial could quickly move a product into the secure 74% of a shopper’s cart. For brands, this makes driving trial an essential strategy for acquiring market share in this price-conscious environment.

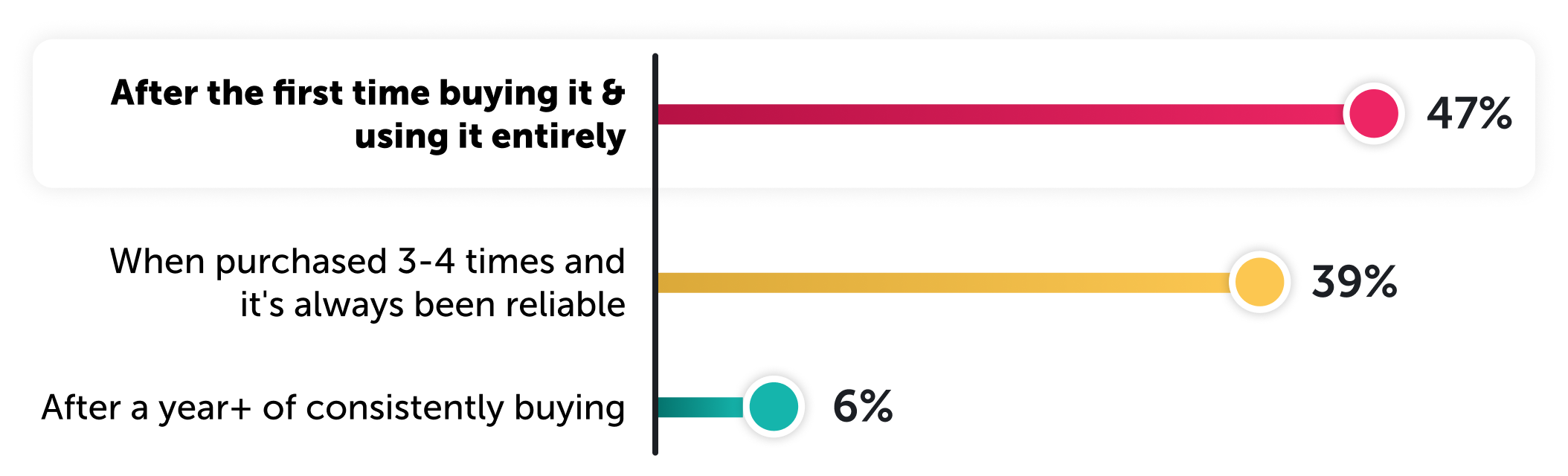

Even a single successful trial can be enough to convert a shopper into a loyal customer. Across categories, most of the consumers we surveyed said that after they’ve bought and used a product once and liked it, they’d consider it part of their new normal and stop buying their old preferred brand.

Unlocking growth: Price and value dynamics across key verticals

The battle for brand loyalty is not monolithic; it shifts from one category to the next. Understanding these vertical-specific dynamics — particularly the inherent friction of getting a consumer to switch brands — is critical for CPG brands looking to drive trial and acquire new customers.

Across all categories, however, a few common drivers underpin every repeat purchase decision: consistent, reliable quality and performance is the top factor, followed closely by the best balance of quality and price.

Let’s drill down deeper.

Reducing switching friction

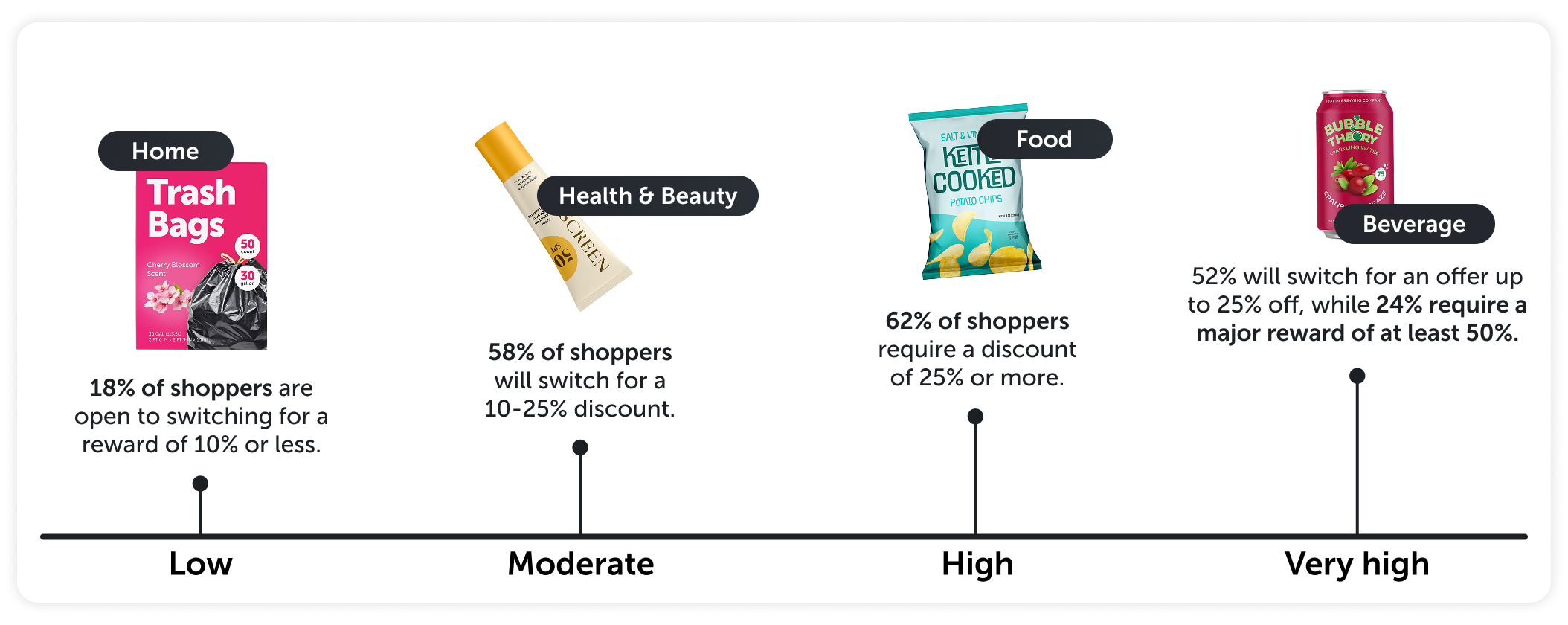

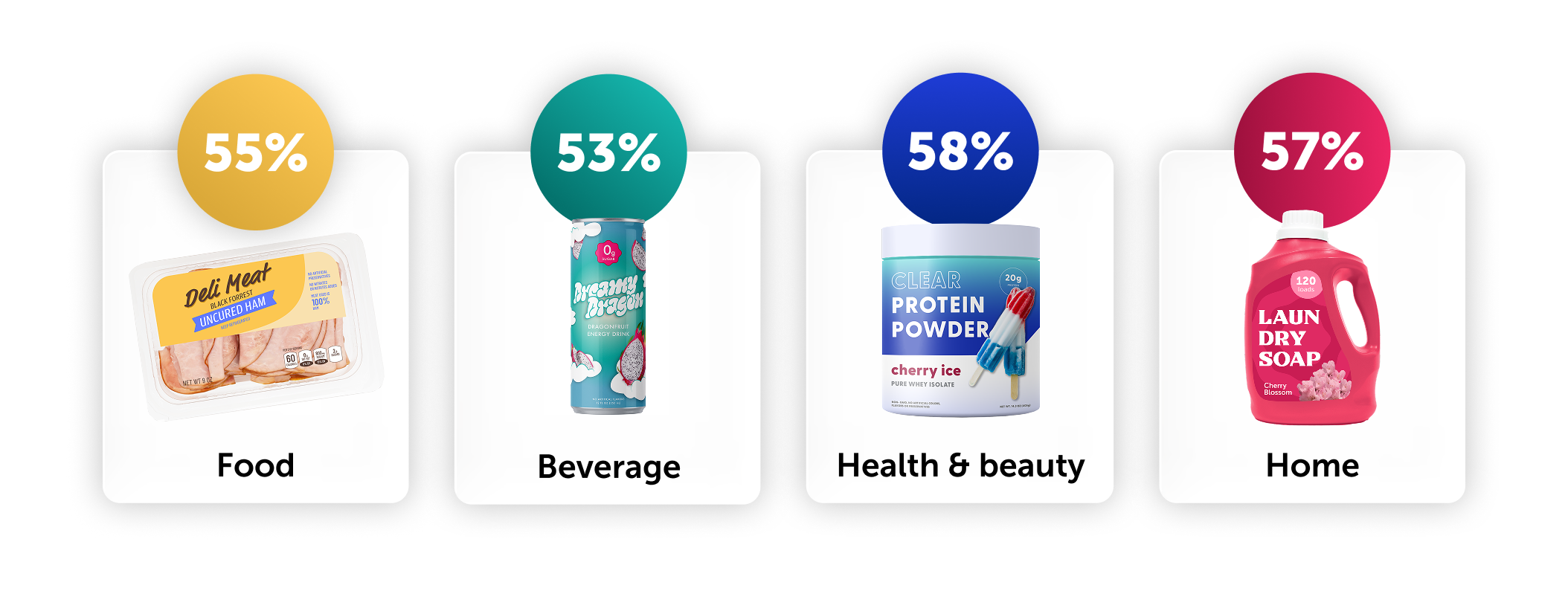

Switching friction — the level of resistance a consumer has to trying a new brand — varies significantly by category. Understanding this friction can help brands determine the level of incentive that will be most effective in disrupting established habits and converting a first-time buyer.

The rewards needed to move the needle in high-friction categories — particularly Food and Beverage — should be viewed as a strategic and worthwhile investment, not an insurmountable obstacle. By leveraging targeted promotions that can better tailor offers to shoppers’ unique loyalty thresholds, marketers can maximize their budgets and drive measurable outcomes for their brands.

Navigating consumer price sensitivity

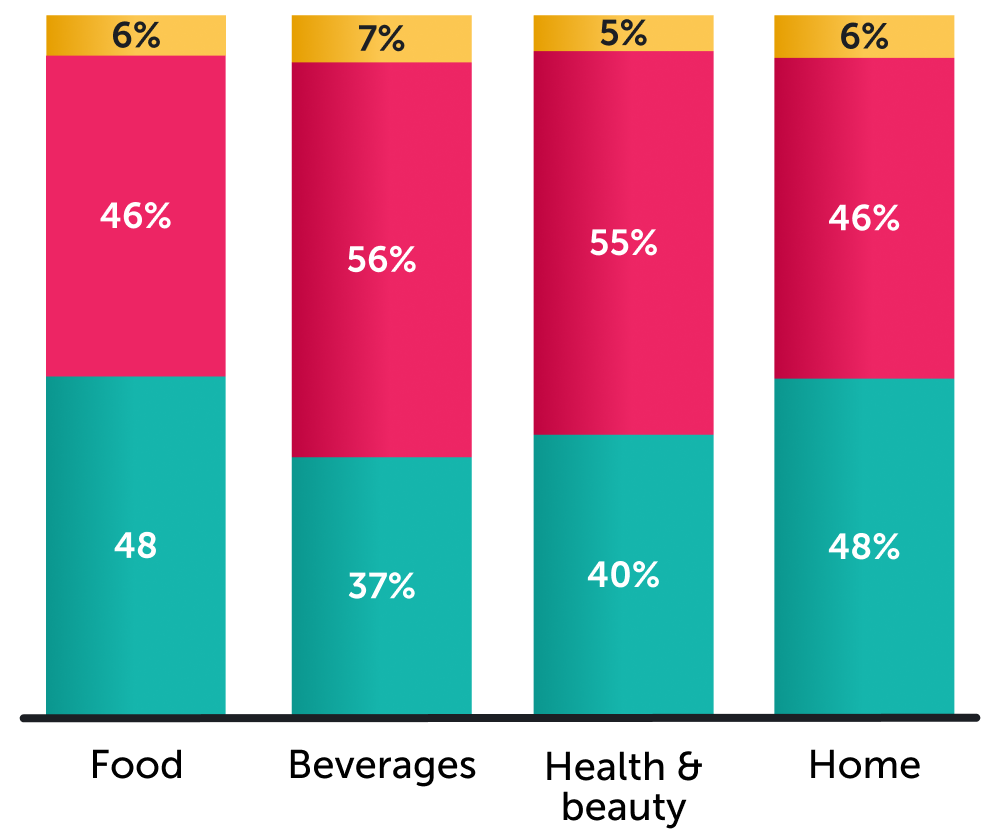

When faced with higher prices, consumers will generally take one of three paths: buy it anyway, trade down to a less expensive alternative, or opt out of the purchase entirely. What path they choose depends largely on what they’re shopping for and whether they consider that item an essential or discretionary purchase.

The data confirms that for both Beverage and Health & Beauty consumers are most likely to buy anyways when it comes to necessities, making these segments less susceptible to trading down. Conversely, in the Food and Home categories, shoppers are nearly split between trading down and buying anyways, highlighting the significant role value plays in their decision-making process for essential items.

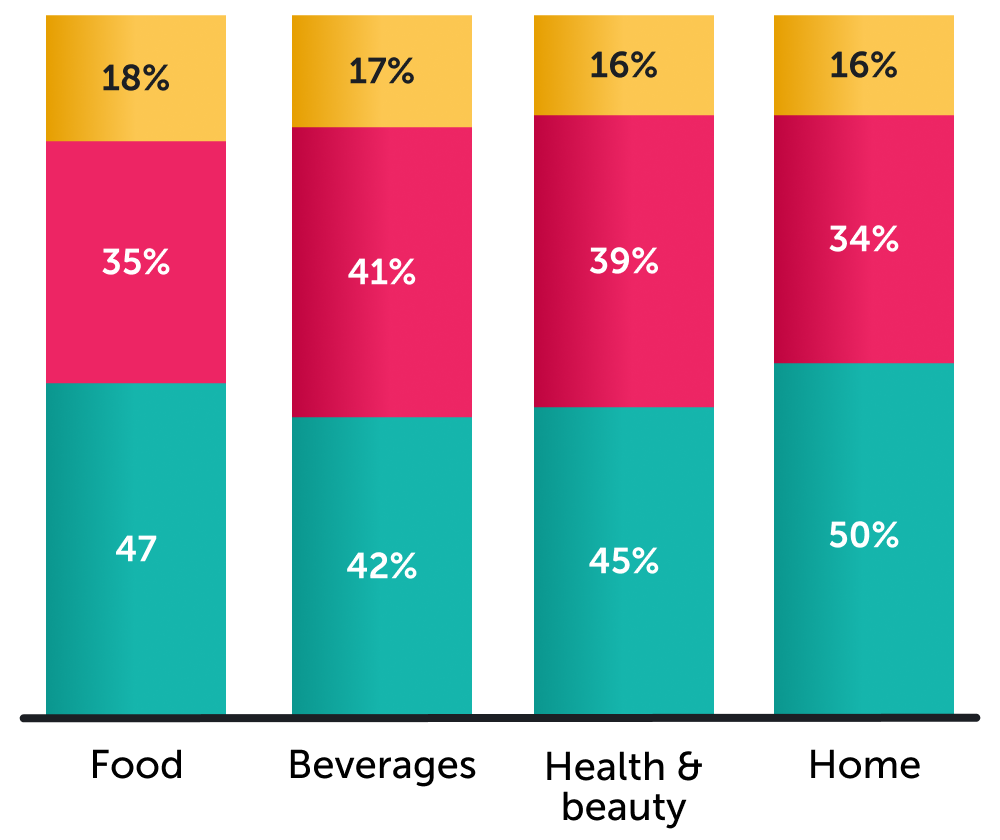

When considering discretionary purchases, a consumer’s willingness to trade down or abandon the purchase altogether increases significantly. The Home category sees the highest rate of trading down for non-essentials at 50%, closely followed by Food at 47%. Furthermore, Food sees the highest rate of completely opting out, with 18% of shoppers surveyed choosing not to make the discretionary purchase at all. For Beverage and Health & Beauty, while trading down remains the most common response, a strong portion of shoppers will still choose to buy the product anyways (41% and 39%, respectively). This indicates that even for discretionary items, their brand or product commitment remains a powerful factor.

The shift toward private label: How store brands are closing the quality gap

Trust parity across categories

The level of trust in private label quality is high across most major categories, though not universal. 62% of shoppers surveyed trust the quality of store brand foods as much as name brands, a parity that suggests a strong foothold for private labels in everyday consumables. The Home category shows similar confidence, with 60% of shoppers surveyed trusting private label quality for household items, demonstrating a high level of faith in store-brand options for products that prioritize guaranteed performance. Trust parity is lower in the Beverage and Health & Beauty verticals, at 55% and 56% respectively. While this still represents a majority of consumers, it does signal that there may be greater stickiness for familiar name brands in these categories, likely due to a higher commitment to taste and routine.

The evolving role of promotions: From loyalty to value layer

The role of discounts and promotions has undergone a fundamental transformation, shifting from a once-powerful loyalty-building mechanism to a now-expected — and critical — layer of transactional value. This affects how promotions shape a consumer’s relationship with a brand — and ultimately, how marketers can best leverage them to drive results.

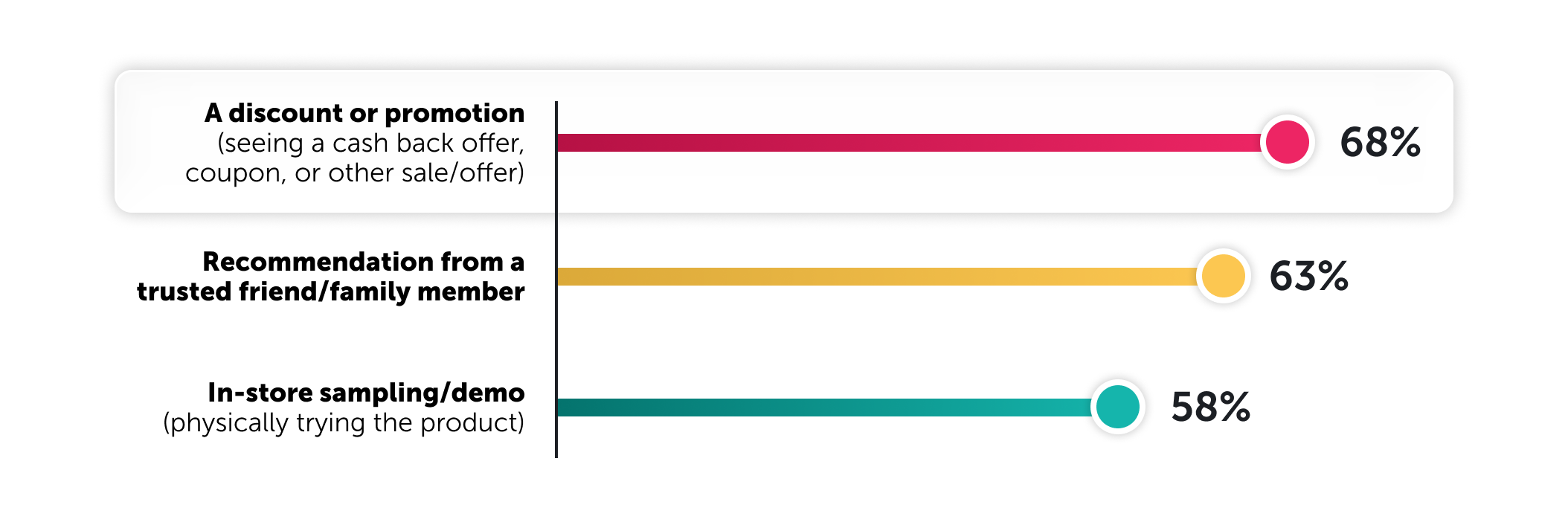

When it comes to actually converting a shopper, discounts and promotions have the most powerful influence. They are the mechanism most likely to move a shopper past initial introduction and toward trial and purchase. This is clearly demonstrated by the fact that 68% of consumers who learned about a new product because of a discount or promotion went on to buy that product. The promotion, therefore, acts as a critical conversion lever, directly translating awareness into a successful first purchase.

Promotions also serve as a key lever for value-added purchasing. Over 50% of shoppers across the Food, Beverage, and Home categories feel justified in purchasing premium items if they find a cash back offer. This "Justifier Effect” allows brands to use targeted rewards to unlock higher-value transactions in an environment where consumers remain highly price-conscious.

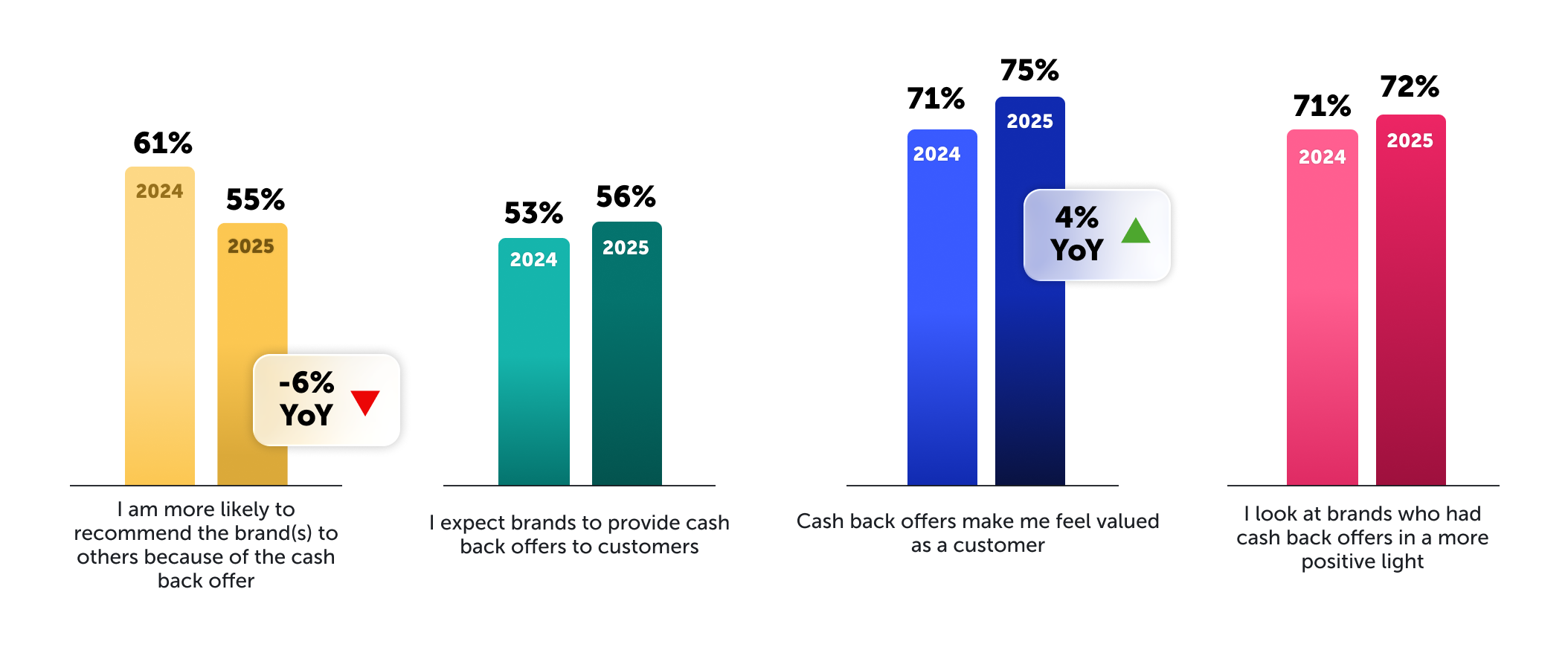

Consumers’ perceptions of rewards remain positive, with the number of consumers who said they feel valued by rewards increasing from 71% to 75% year over year. However, the data also shows a measurable decline in brand recommendations resulting from these offers. Today, 55% of consumers say they’re likely to recommend a brand to others because of a cash back offer, down from 61% the year prior. This suggests that while rewards continue to be an effective way to generate goodwill amongst consumers, their role in turning shoppers into brand advocates is softening.

Promotions — particularly digital ones — play an especially critical role in consumers’ savings routines. Of the people we surveyed, 64% said they’d used digital coupons or cash back to save on groceries in the last month. This outranked all other savings tactics, including in-store sales and buying store brand or generic products.

In fact, promotions have become so ingrained in shoppers’ routines that 56% of shoppers surveyed now expect brands to offer them. This underscores one key takeaway: Promotions are no longer a nice to have but rather a fundamental part of any successful marketing strategy.

This evolving dynamic necessitates a strategic shift in how brands view and deploy their promotional spending. Rewards are more important than ever for influencing purchasing decisions and making a shopper feel appreciated for that purchase. However, one-off promotions are no longer sufficient for securing long-term, deep-seated brand loyalty in a shopping environment where the best overall value proposition wins.

2026 outlook: How consumer spending patterns will change

The insulated shopper has effectively stabilized their routine against economic pressures, but the consumer landscape remains dynamic. While the core behavioral trends we’ve identified — from price-first decision-making to promotions as an expected value layer — will persist, the market is poised for additional shifts in 2026. Consumers are not just reacting to the economy anymore; they are proactively making intentional decisions about where and how they plan to spend their money.

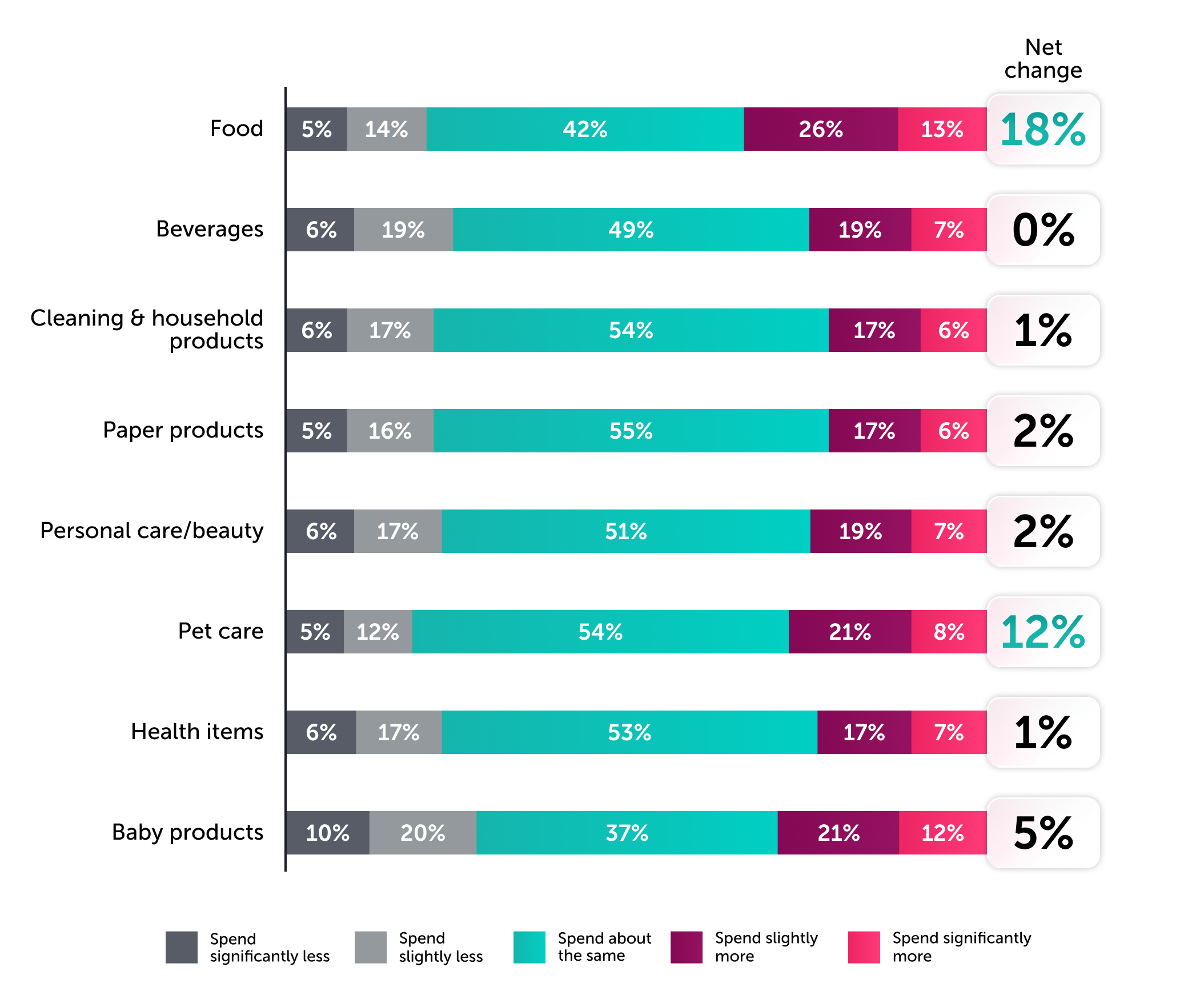

Based on shoppers’ spend predictions for this year, we expect to see an increase in spend across the Food (18% net increase) and Pet categories (12% net increase), with Baby products also seeing a notable increase (5% net increase) compared to other categories. Absent a continuous rise in purchase incidence, spending in all other categories is expected to remain relatively flat.

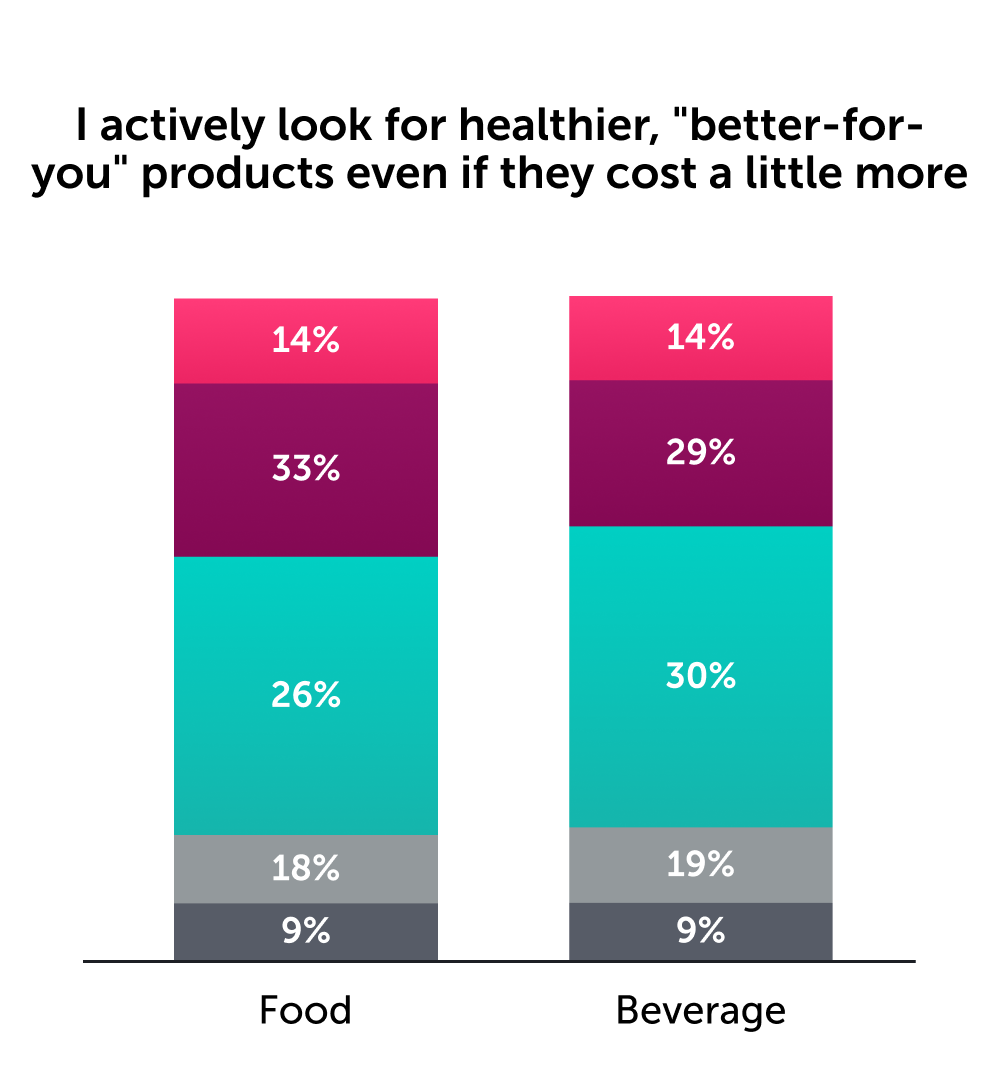

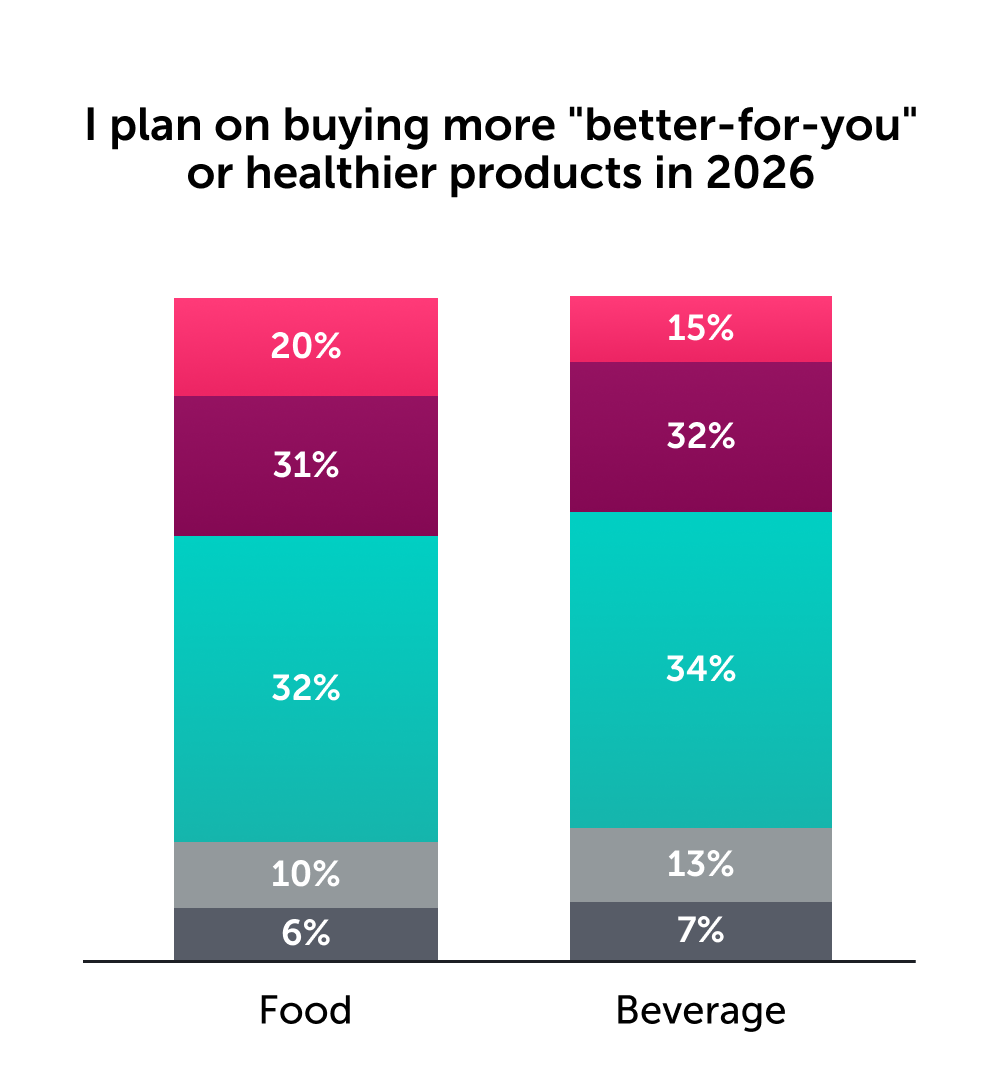

One potential reason for the expected growth in the Food vertical is the rise of “better-for-you” products both on shelves and in shoppers’ carts. 52% of food shoppers surveyed plan to buy more "better-for-you" products in 2026, which is a jump from the 47% who are already actively seeking those options now — even if they come at a higher cost. Furthermore, this future growth is supported by an additional 18% of those not currently prioritizing better-for-you options who plan to do so this year.

The beverage vertical shows a similar trajectory. 43% of consumers surveyed are actively looking for healthier options, and 46% of beverage buyers plan on increasing their purchases of these items in 2026.

This willingness to prioritize healthier options — even at a higher cost — presents a clear growth strategy for CPGs. Brands should invest in the premium, "better-for-you" segment, but crucially, they must pair it with a value lever. By deploying personalized promotions and cash back offers, marketers can leverage the "Justifier Effect" to bridge the price gap and unlock high-value transactions that secure a position in the consumers’ increasingly health-conscious routines.

Navigating the new normal in 2026

The 2026 consumer landscape will continue to be defined by the insulated shopper, who has successfully stabilized their routine against economic volatility by making price and perceived value the most important considerations in their purchasing decisions. This shift has cemented the challenge for CPG brands: the market-share battle is now confined to the small, highly competitive 26% of the cart made up of first-time purchases. To break in, brands must accept offering the kinds of compelling incentives that effectively drive trial.

Furthermore, promotions have evolved into an always-on strategic layer that’s critical for conversions, driving both value-driven and premium purchases. Moving forward, success for CPGs depends on a dual strategy: strategically investing in trial to break into the 26% and then building long-term loyalty — the kind that secures a spot in the habitual cart — based not on sentiment but on the most compelling, consistent value proposition.

For CPG brands navigating this new normal, the Ibotta Performance Network (IPN) offers the essential playbook for success. The IPN provides the insights and solutions brands need to overcome switching friction and cement their position in the modern consumer’s grocery cart.