April 27, 2023

As brand leaders look to maximize incremental sales during the Back to School season, Ibotta recently conducted multiple, comprehensive consumer surveys to understand the shopper mindset regarding product loyalty and brand switching.

Consumer sentiment: Deals & Cash Back matter most

The findings reveal that the leading purchase drivers for shoppers who are not loyal to a specific brand — already open to the full selection of competitors — are getting a good deal (83%) and getting cash back (69%).

Interestingly, even when shoppers are loyal to a particular brand, they continue to prioritize good deals (66%) and cash back offers (59%) in their purchasing decision process.

In both cases, promotional incentives emerge as the key to capturing shoppers and driving incremental sales. Other factors like product quality (41% for those open to other brands; 28% for brand-loyal shoppers), personal recommendations (39% and 27%, respectively), and brand alignment with ethics (10% and 8%) have considerably less sway over their purchasing decisions.

Back to School season-specific findings, 99% of shoppers seeking deals

Drilling down specifically on the Back to School season, further user-submitted responses affirm the aforementioned insights while providing additional context.

Highlights:

-

72% of shoppers will be participating in Back to School shopping this year.

-

Of them, 79% are purchasing items for their children or young relatives; 19% are purchasing for themselves; 12% for charitable donations; 11% (are teachers) purchasing for their classroom.

-

99% of shoppers will be looking for Back to School deals for at least one of the categories they plan on buying from

-

69% of shoppers will trade down to private label or a competitor, or shop at a different store, if they can’t find a coupon/deal for what they plan to buy.

-

85% of shoppers will try out a new or different brand if it’s offered at a lower price than what they would typically buy (assuming the quality is equal).

Seasonality

Inflation and macroeconomic instability are imposing a significant financial strain on consumers. 80% of shoppers claim the economy has a direct impact on their spending habits; 77% believe the current US economic conditions are poor (48%) or fair (29%) — as also found in the aforementioned survey data.

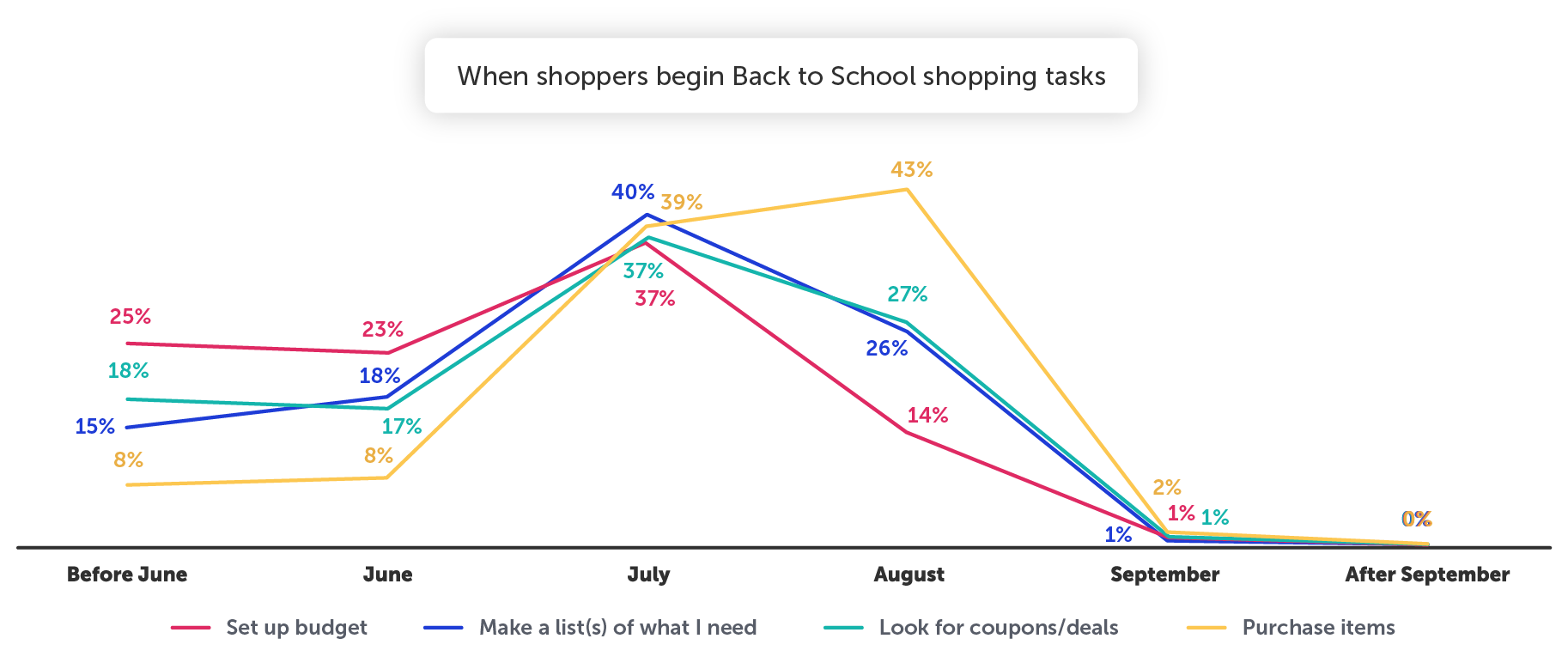

Predictable purchasing surges during the Back to School season months present a compelling opportunity for brands to win new shoppers and build loyalty through promotional campaigns.

In fact, this compelling opportunity to offer the right incentive to the right customer at the right time, during the Back to School season of 2023, may be a requirement — to avoid losing share of wallet.

Given the rise of private label (see below), the writing is on the wall. Driving efficient growth will rest largely on an ability to incentivize shoppers back to your brand and convert new-to-brand shoppers.

.png?width=5001&height=3514&name=Summer%20Kickoff%20Blog%20Graphics_additions%20(2).png)

Seasonality trends by category

Jump ahead to:

Given the economic climate, for years ahead and 2023 particularly, brands are well advised to activate ahead of these July increases and invest in awareness raising initiatives such as coordinated promotional campaigns to remain top of mind throughout the successive months to protect share of wallet.

1. Use the tables below to identify categories that surge in purchase volume during Back to school months and run pay-per-sale offers to combat price sensitivities and shoppers trading down, protecting market share.

2. Gain deeper insights: private label impact in your category, the best time to launch seasonal campaigns, tailored recommendations to maximize market share — by contacting your Ibotta representative.

.png?width=1100&height=784&name=Seasonal%20Trends%20-%20BTS%20-%20Blog%20Graphics%20-%20General%20Food%20(1).png)

.png?width=1100&height=784&name=Seasonal%20Trends%20-%20BTS%20-%20Blog%20Graphics%20-%20Beverages%20(1).png)

.png?width=1100&height=784&name=Seasonal%20Trends%20-%20BTS%20-%20Blog%20Graphics%20-%20General%20Merchandise%20(1).png)

.png?width=1073&height=765&name=Seasonal%20Trends%20-%20BTS%20-%20Blog%20Graphics%20-%20Health%20%26%20Beauty%20(2).png)

.png?width=1100&height=784&name=Seasonal%20Trends%20-%20BTS%20-%20Blog%20Graphics%20-%20Household%20Needs%20(1).png)

Takeaways

Inflation and economic uncertainty are driving significant financial burden on shoppers while prompting brands and retailers to gain a nuanced understanding of consumer sentiment. By accurately gauging the pulse on consumer sentiment, advertisers can apply these insights to historical data and seasonal trends, ultimately building a sound strategy.

Additional findings

The economic landscape (particularly in regard to retail and consumer impact) of the latter half of 2023 will be determined by how many matters unfold.

-

From December 2021 to December 2022, food prices increased 10.4% and ‘food at home’ prices increased 11.8%.¹

-

Most of American consumers’ pandemic savings “has been spent, as the savings rate has dropped from an average of around 9% before the pandemic to around 3% in the final quarter of 2022.”²

-

Private label grew 2X the rate of national brands in 2022, accounting for 29% of new retail sales.³

|

Connect with your Ibotta rep to dive deeper into category-specific historical data and plan out robust promotional campaigns to drive incremental sales and win market share. |

Planning for a different season? Check out the Category Pacesetters tool to see which categories over index for any month of the year. |

Stay tuned for key seasonal guides to come: Holiday 2023, New Year’s Resolutions. |

Brands, retailers, and advertisers who join the IPN gain access to deep insights and proprietary data to identify new opportunities for effective promotional strategies — inquire here to learn more.

![]()

Achieve your brand goals

Which metrics are most important for your brand? Get in touch to explore possibilities with the Ibotta Performance Network.

¹Bureau of Labor Statistics, 2023.

²PLMA, 2023.

³Deloitte, 2023.