September 3, 2025

What You Need To Know

-

This year, holiday shoppers are buying later in the season than we’ve seen in the past 5 years. Timing your promotional offer correctly will determine success.

-

People are holiday shopping whenever they can and wherever they are (think picking up a fun toy at the grocery store), so finding ways to engage them across categories will drive incremental sales.

-

Promotions are the solution to consumer price sensitivity and can drive brand loyalty.

-

BevAlc brands can win the season with wide-scale promotions and delivery.

It goes without saying that the holiday shopping season is critical for brands across categories. And 2025 promises to be no different, as consumers struggle to find the balance between wanting to celebrate and a need to save. Brands can't just run the same old holiday campaigns and expect results.

We analyzed first-party receipt data from purchases across the Ibotta Performance Network and surveyed over 1,500 holiday shoppers to figure out what's actually happening this season. Here's what the data tells us, and more importantly, what you should do about it.

5 holiday strategies that matter

1. Timing is everything: Get your offers live for peak holiday weeks

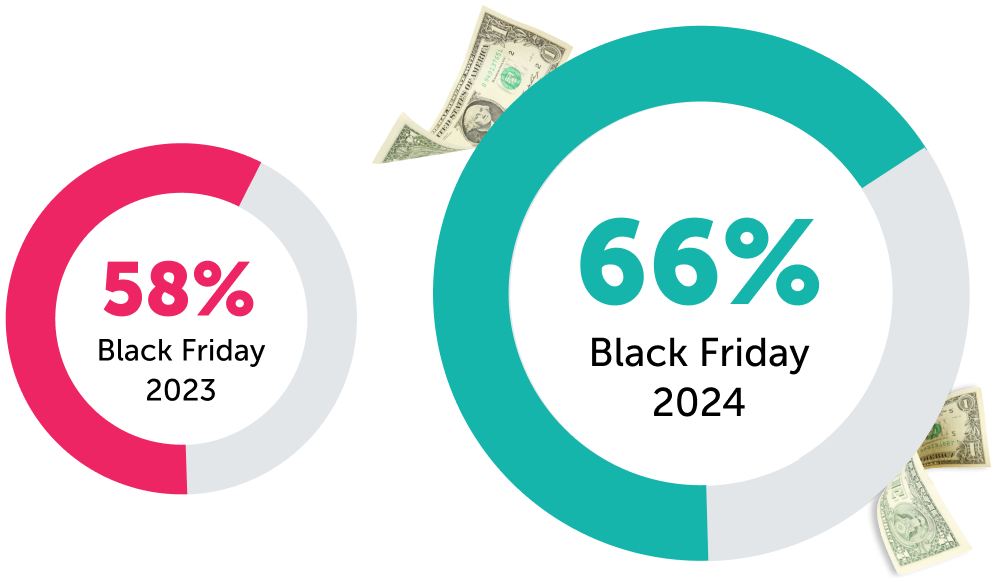

The classic assumption around holiday shopping always centers on the idea of "shopping earlier" and how the holidays start closer to Halloween than Thanksgiving, but the numbers tell a different story. In 2024, 66% of shoppers stated they would do most of their holiday shopping in November and December. This year? That jumps to 86%. That's a 30% increase in last-minute shopping, which means your timing better be spot-on.

The redemption data backs this up:

WoW increases in offer redemption rates during the holiday season (2024)

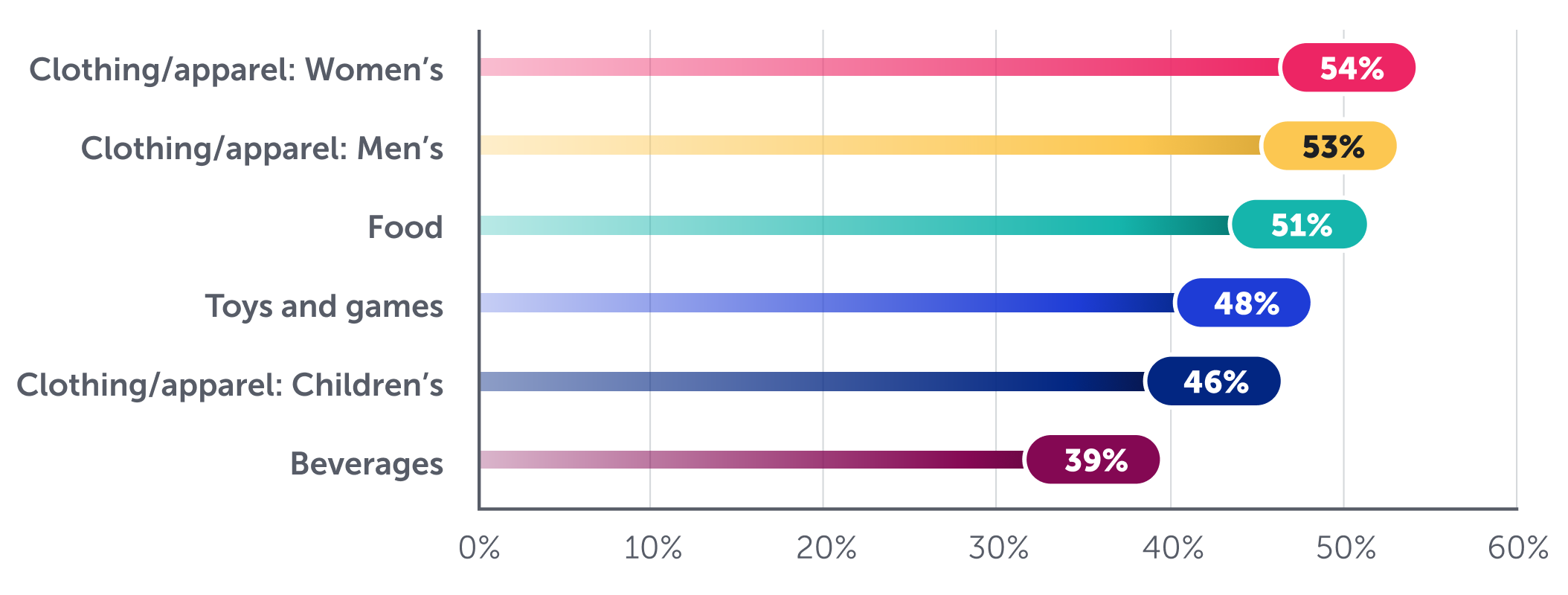

This isn't about consumer behavior theory—it's about when people actually pull out their wallets. If your offers aren't live during these peak weeks, you're leaving money on the table. Apparel, toys, food, and beverages are leading the charge, so these categories especially need to hit hard during high purchase-intent moments.

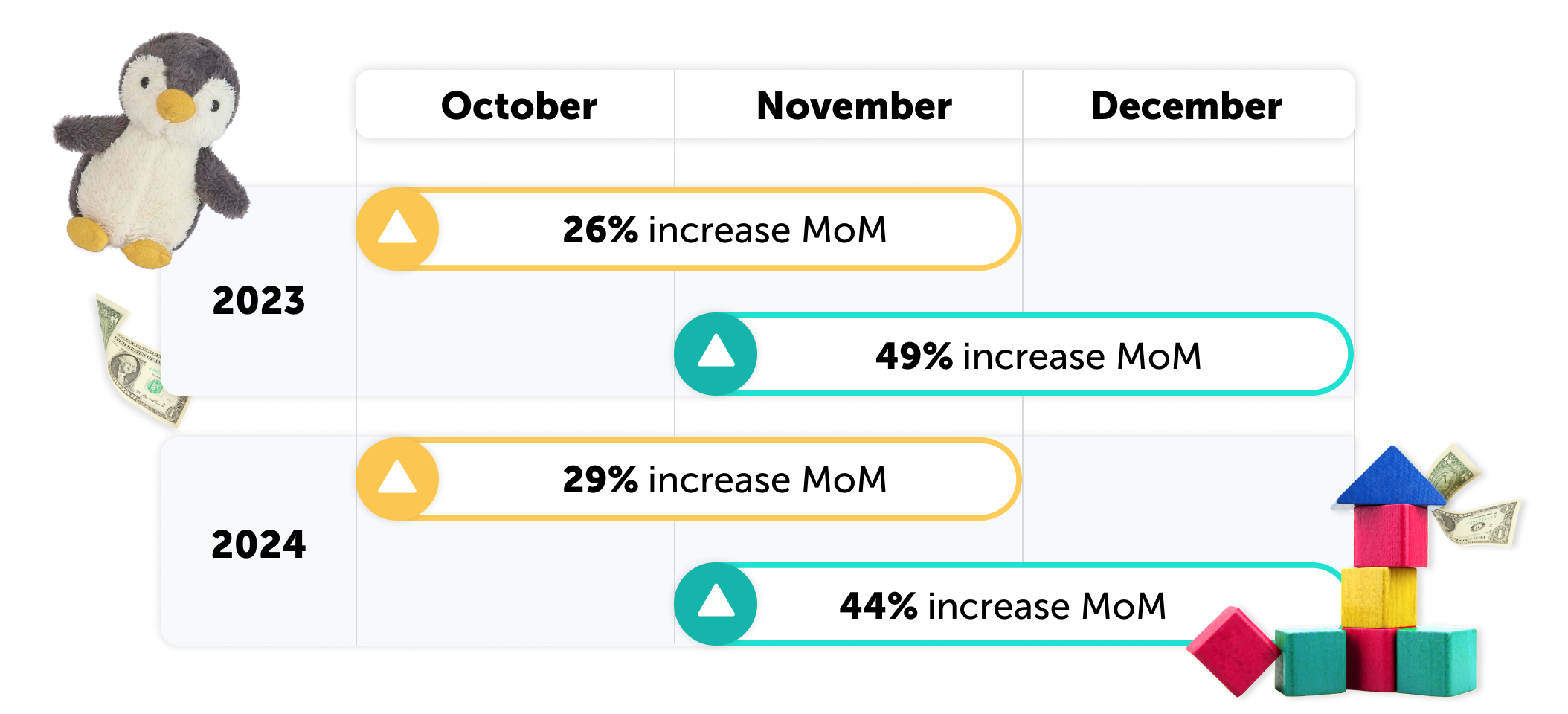

2. Single category shopping isn’t real life: Shoppers are consolidating everything

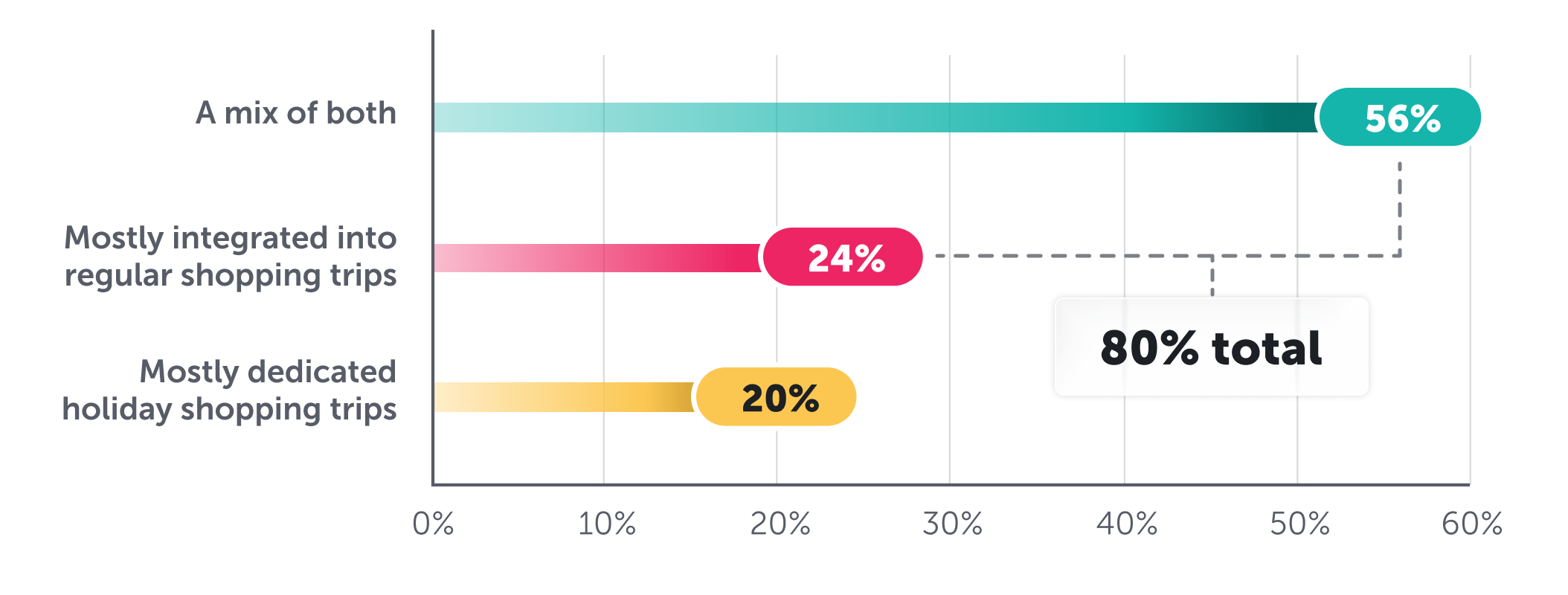

Modern shoppers aren't making separate trips for groceries and gifts anymore. They're models of efficiency. Our data shows multi-category baskets that include toys jumped nearly 50% from November to December in both 2023 and 2024. Translation: People are buying dinner ingredients and kids' presents in the same cart.

Here's the reality: 80% of shoppers blend holiday purchases into regular shopping trips. This means you need to be visible where they're already shopping—in loyalty programs at big box stores, on major platforms, and in cash-back apps like Ibotta, where they can discover both grocery deals and gift options in one place.

Stop thinking about your category in isolation and start thinking about being a part of the entire shopping trip.

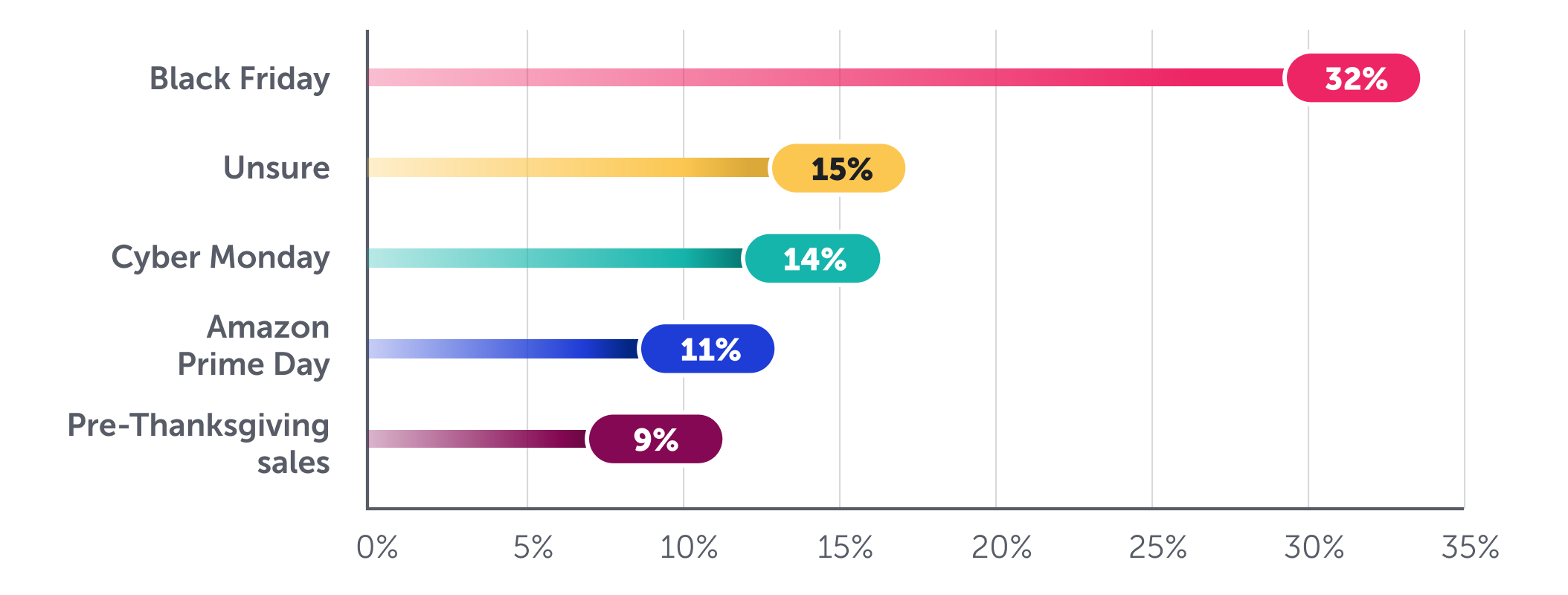

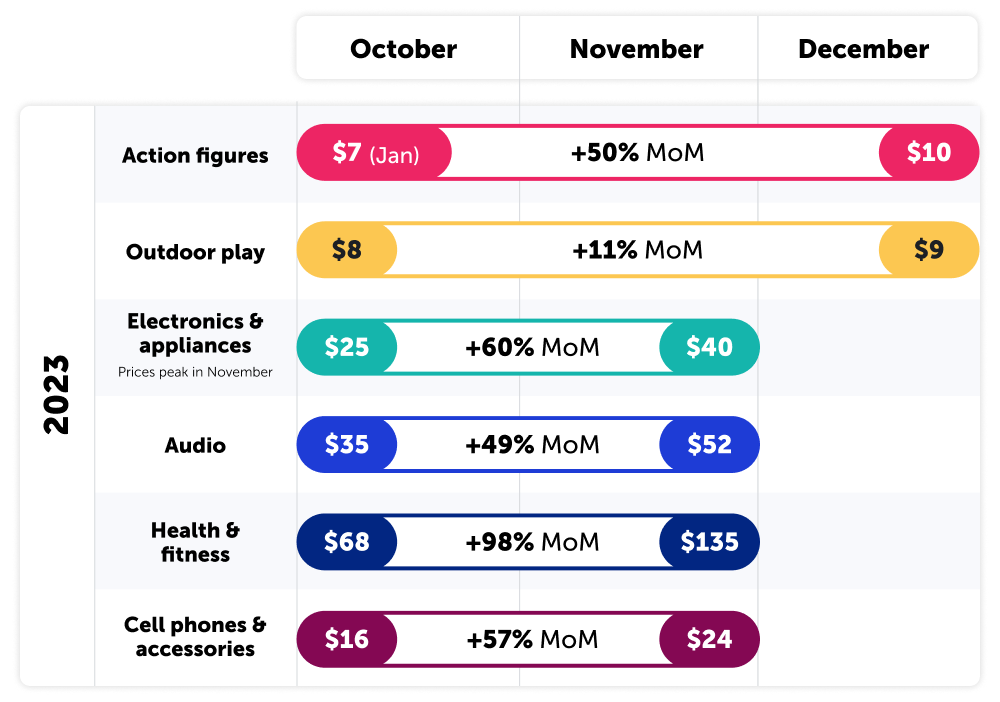

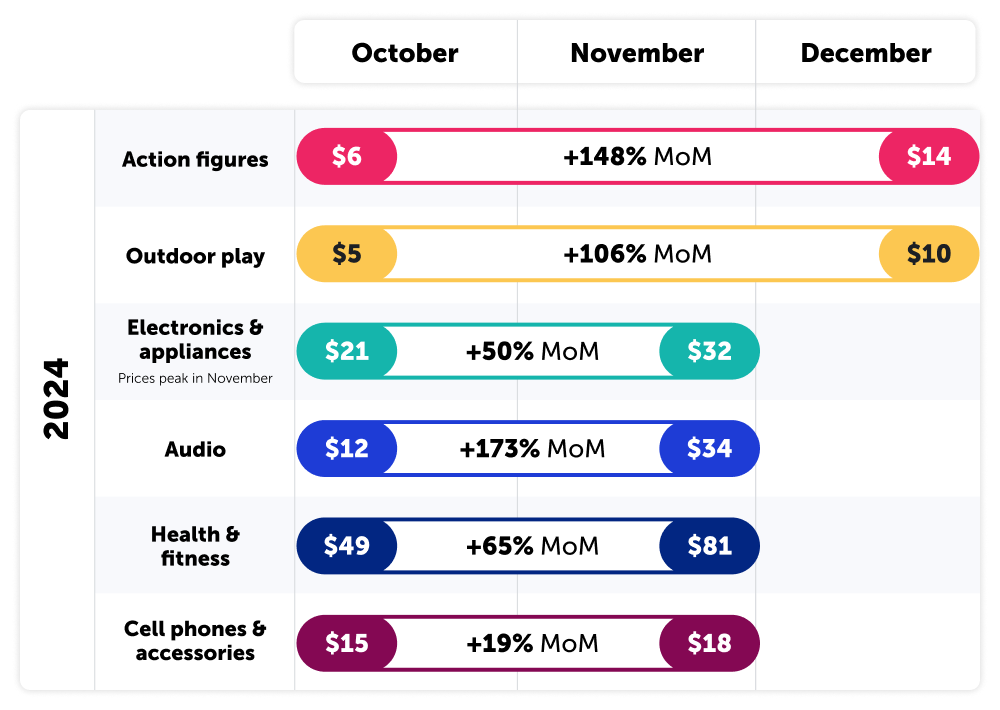

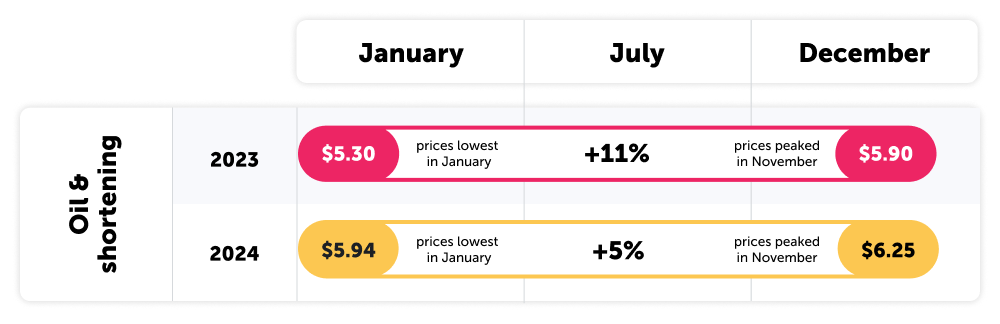

3. Countering peak pricing: Why your promotions are shoppers’ best bet

When consumers encounter higher-than-expected prices on these in-demand items, promotions become incredibly valuable. By offering attractive deals, your brand can capture the attention of price-conscious and brand-agnostic consumers who are actively seeking better value, allowing you to stand out and capture market share against a backdrop of increasing seasonal prices.

Brands are strategically increasing base prices when demand peaks. This creates a massive opportunity: When shoppers encounter higher-than-expected prices, genuine promotions become incredibly valuable. You can capture price-conscious, brand-agnostic consumers who are actively seeking better value. Win brand loyalty while competitors are raising prices.

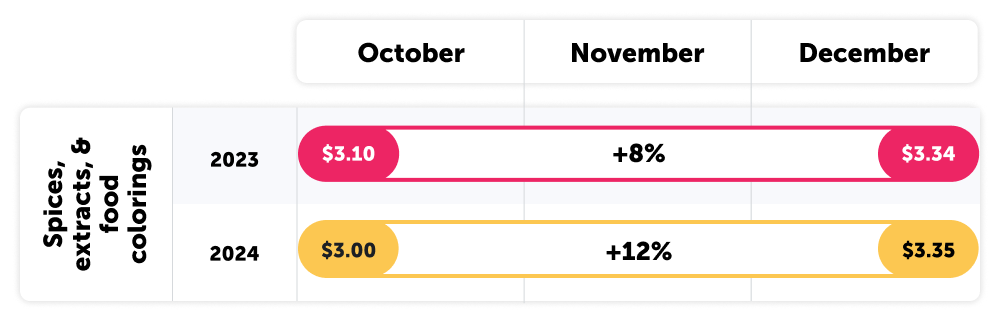

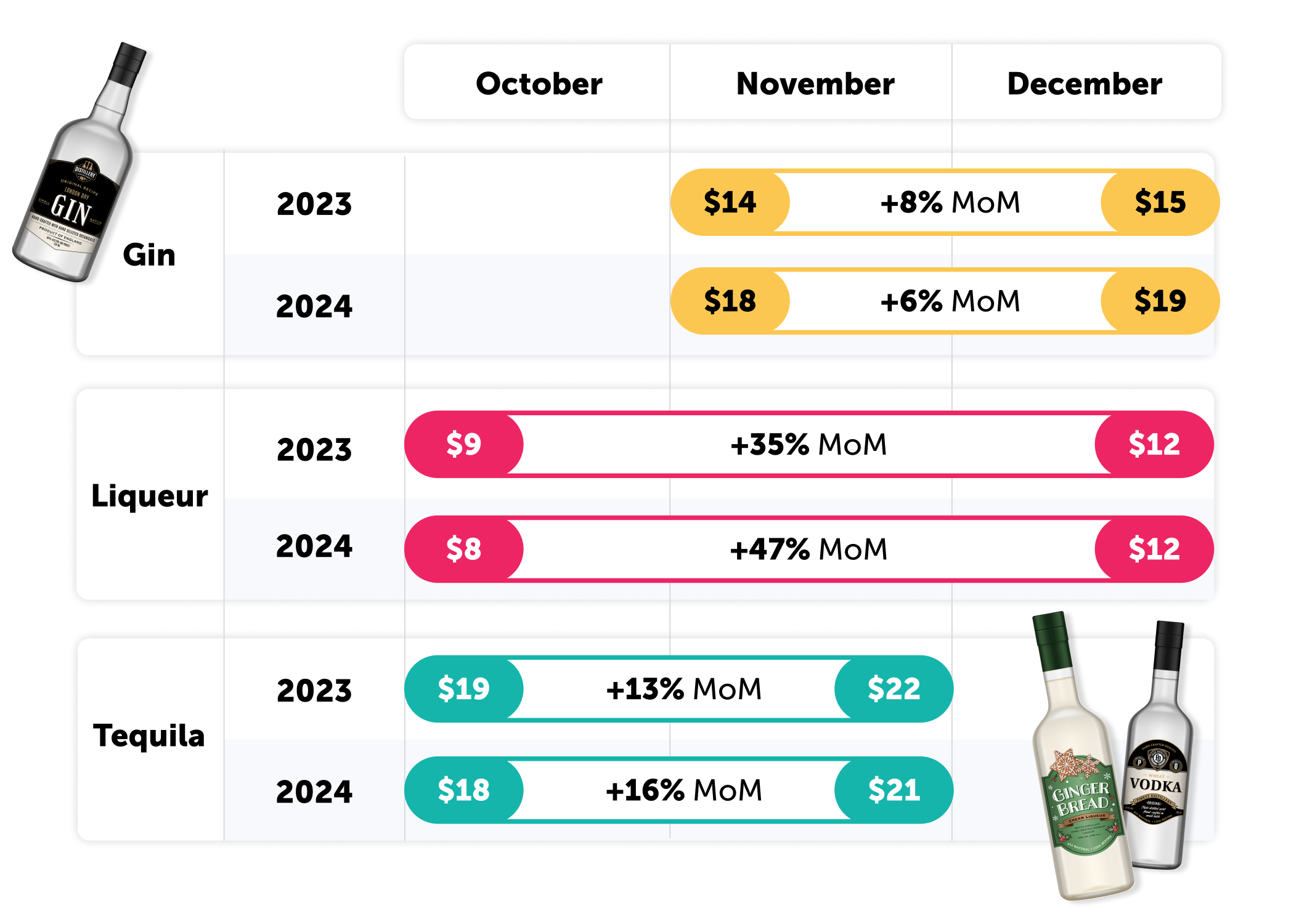

4. BevAlc Brands: Win the season with promotions and delivery

Alcohol is everywhere during the holidays (parties, gifts, stress relief). But what’s easy to miss is that like the categories we just reviewed in our previous point, BevAlc prices also increase during the holidays.

Look at these increases:

As your competition raises prices, wide-scale promotions paired with seamless delivery become your competitive edge. You're not just offering a deal—you're offering convenience when people need it most. Luckily, the IPN does just that through our latest partnerships, enabling your BevAlc brand to win the season.

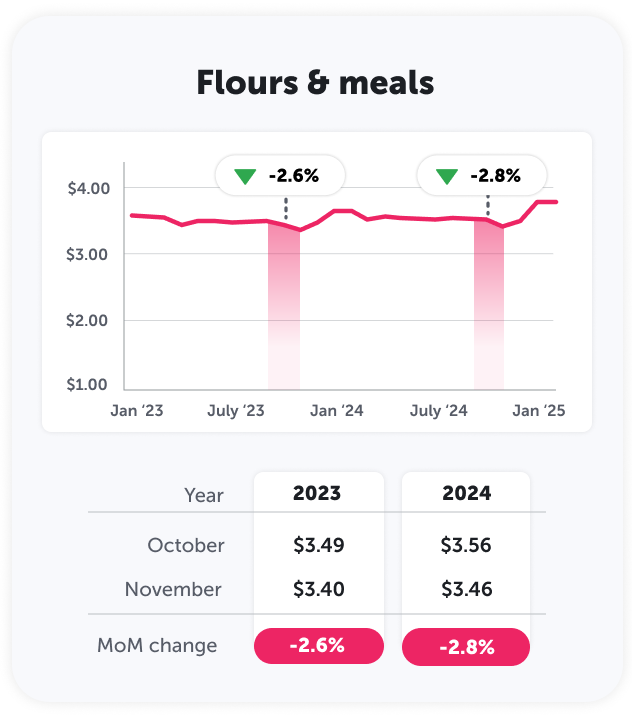

5. Capitalize on high demand: Drive volume when prices are lowest on seasonal products

Not everything gets more expensive during the holidays. Some seasonal essentials, particularly baking goods, hit their lowest prices of the year in November and December. When base prices are down and demand is up, that's your moment to drive serious volume.

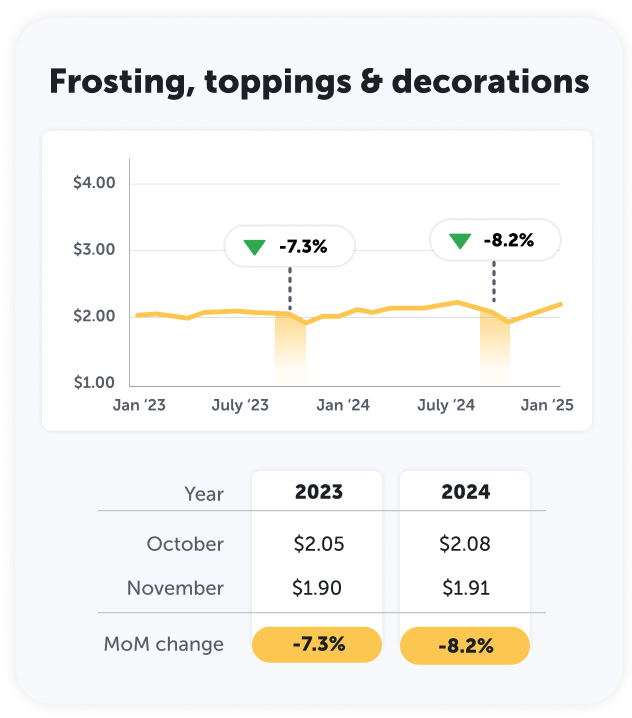

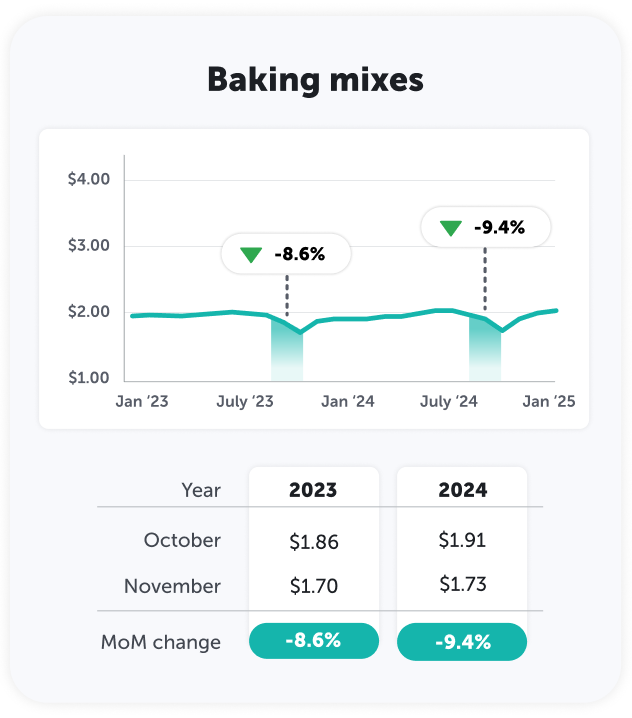

In 2024, baking mixes dropped to seasonal lows in November—$1.71 versus $1.86 the month before. Frosting, toppings, and baking decorations follow the same pattern. Flours and meals also become more affordable.

Average price changes for baking goods

During these periods of high demand and low base prices, promotions become irresistible to price-conscious shoppers stocking up for holiday baking. This is where you convert people planning to buy private label or competitors and ensure your brand fills their holiday pantry.

Wrapping up how your brand can win this season

The holidays are a dynamic period that rewards brands who understand the data and not the season’s greetings. The brands that will win the season will get specific about timing, think beyond their category, capitalize on pricing inefficiencies, and move fast when opportunity arises.

The IPN moves brands from guesswork to strategy and tactical spend and could just decide on how joyous the season turns out to be.

Get in touch to leverage these insights further and get a custom strategy specific to your brand's goals this holiday season.