April 24, 2025

Summer 2025 is poised to be a pivotal season for CPG brands. Navigating the delicate balance between capturing the excitement of summer spending and addressing consumers’ heightened price sensitivity due to economic pressures demands more than just sunny-day marketing. It requires a strategic and data-driven approach.

This year's Summer Outlook dives deep into the latest consumer sentiments, overlaying them with categorial insights from Ibotta's shopping data. Our goal? To equip your brand with insights and strategies that will help you not just keep pace but shine bright this summer in the face of evolving consumer behavior.

Prices are top of mind for the summer shopper

The current economic climate, marked by persistent inflation, ongoing supply chain issues, and evolving trade policies, has significantly impacted grocery prices — and will continue to. To better understand how these economic conditions shape consumer spending and summer plans, we surveyed more than 1,400 users of the Ibotta app in early April.

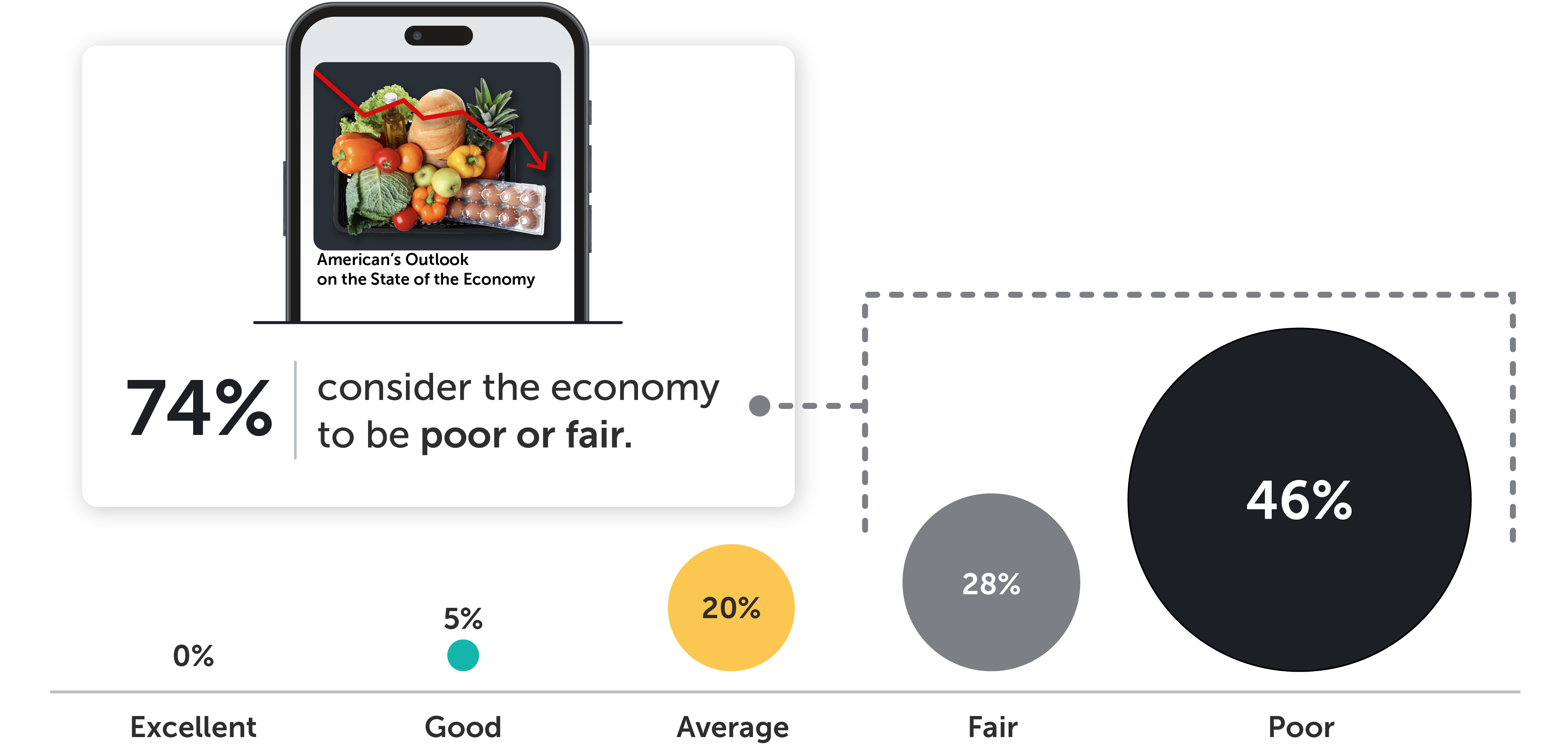

The survey results reveal that consumers’ current economic perception is primarily negative. A significant majority (74%) of respondents consider the economy poor or fair, indicating a widespread lack of confidence in financial conditions. In such an uncertain economic environment, consumers are likely to be more cautious with their spending, with 82% of respondents expecting grocery prices to surpass those of last year. These concerns are contributing to a higher need for savings, especially for the upcoming summer season.

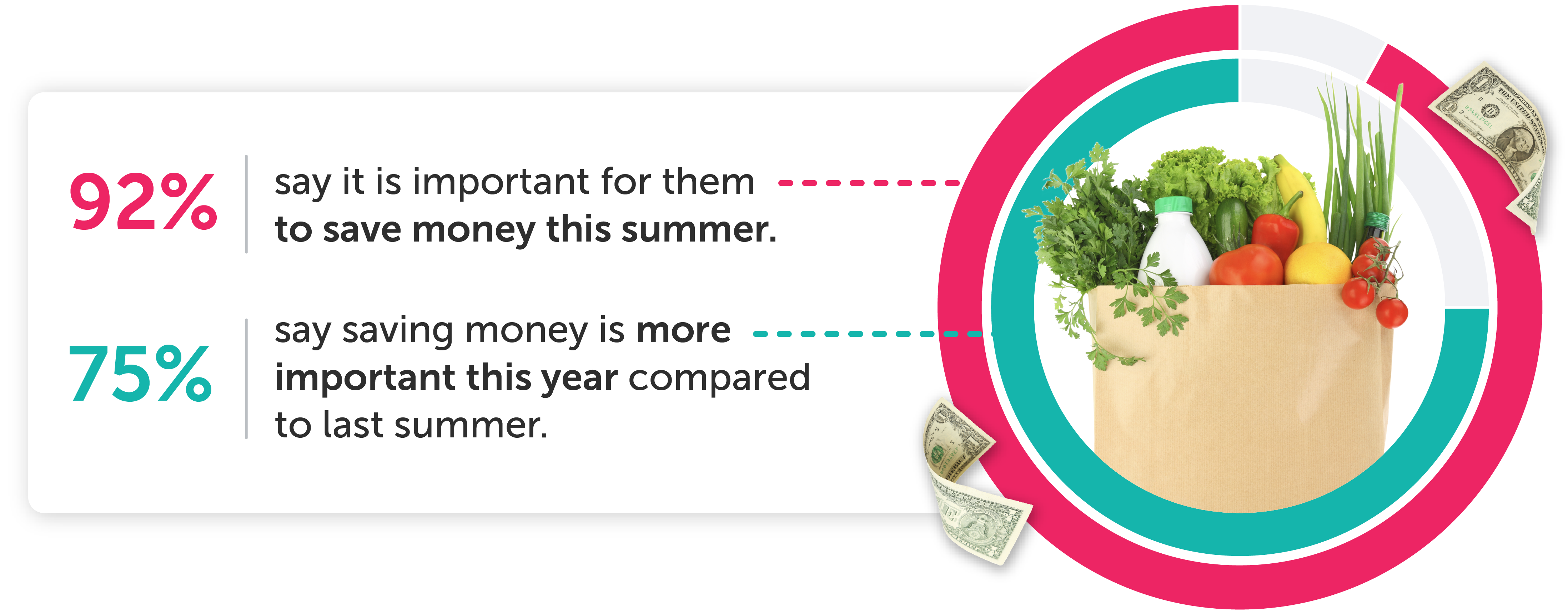

A significant 92% of surveyed consumers stated that it’s important for them to save money this summer. And when the group was asked to compare their current feelings to those of last summer, three-quarters indicated that saving money is more critical. This notable increase in the perceived importance of saving money for the upcoming season suggests a shift in consumer behavior and spending habits. Therefore, it’s important to take a deeper look into the data to gain insight into what could be on the horizon for CPG brands.

7 trends CPG brands can expect this summer

1. Seasonal increases in health and wellness products are expected to return.

When Ibotta app users were asked the top five activities they are looking forward to this summer, 48% of respondents said outdoor activities and 40% said improving their health and fitness. So it’s no surprise that we’ve also seen a rise in purchases of diet, nutrition, and other healthy grocery items in the months leading up to summer, particularly in recent years.

The diet and nutrition category saw an 18% increase in units moved compared to all categories from Q1 2024 to 2025 and an even greater 28% increase from Q1 2023 to 2025. An increased consumer focus on health-related grocery trends lasts into the summer as well. For example, diet and nutrition products saw a 15.8% increase in branded units moved in the summer of 2024 compared to the same window in the year prior.

The diet and nutrition category saw an 18% increase in units moved compared to all categories from Q1 2024 to 2025 and an even greater 28% increase from Q1 2023 to 2025. An increased consumer focus on health-related grocery trends lasts into the summer as well. For example, diet and nutrition products saw a 15.8% increase in branded units moved in the summer of 2024 compared to the same window in the year prior.

Health products extend to many other subcategories besides diet and nutrition. As the temperature rises, so does the need for hydration products. Sports and energy drinks often see major spikes before and during the summer season. Branded sales of sports and energy drinks were up 11.6% year over year. This trend is also seen in 2025 data, with double-digit increases in units moved for sports and energy drinks over the years: a 15% increase from Q1 2024 to 2025 and a 19% increase from Q1 2023 to 2025. The growth over the previous summer seasons and in Q1 displays a shift in consumer purchasing behavior. This aligns with other data, such as For Insights Consultancy’s 2024 Market Report, which expects the sports and energy drink market to grow at a 8.7% CAGR, going from $64.3 billion in 2023 to $113.5 billion by 2030. This heightened interest in health-focused products, especially during the summer, opens the door for brands to increase their sales.

2. Grilling season will increase demand for meat and other outdoor barbecue essentials.

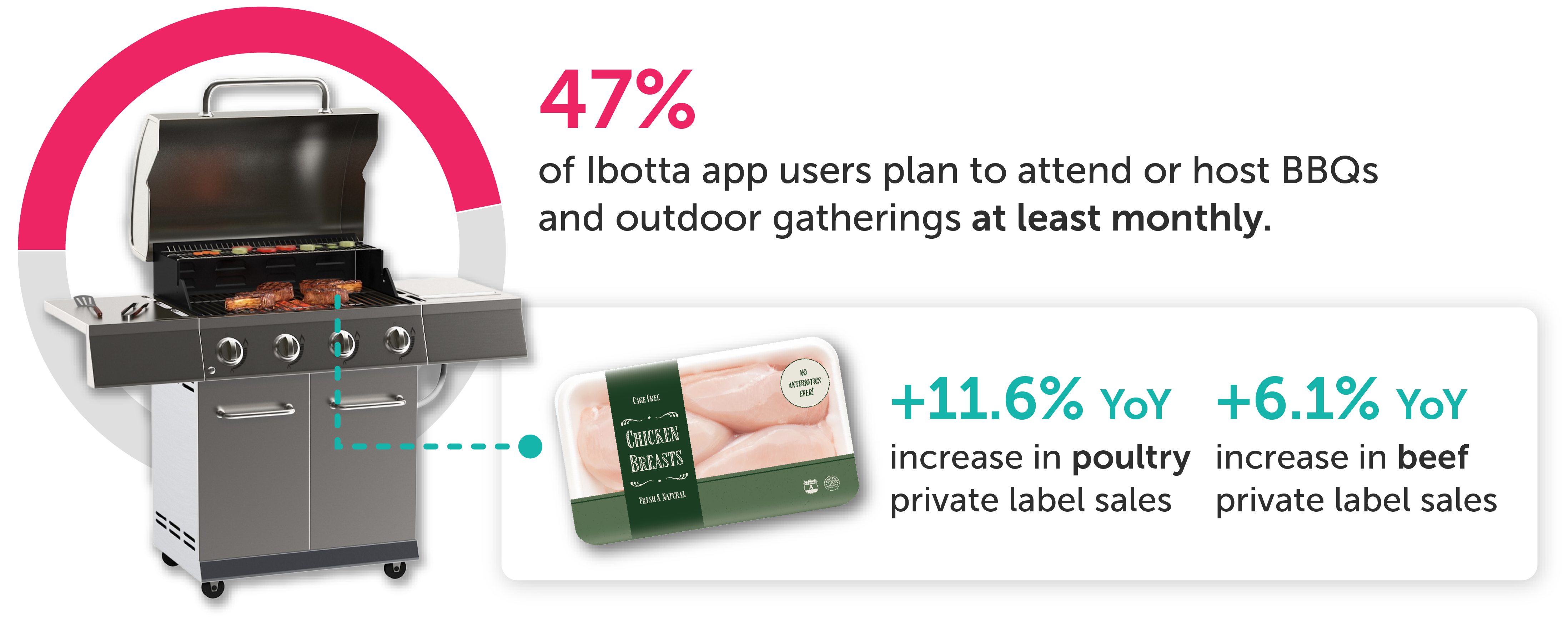

With the grilling season making its long-awaited return, 40% of Ibotta app users stated that BBQs and picnics are some of the top activities they are looking forward to this summer. Additionally, 47% plan to attend or host BBQs and outdoor gatherings at least monthly. Our data from summer 2024 showed that meat saw large year-over-year increases in private label sales with significant jumps in units moved of poultry (11.6%) and beef (6.1%). Beef in Q1 2025 also saw a 16% increase in units moved when compared to all categories from the previous year.

Related subcategories also saw growth in previous summers. Some of the largest year-over-year increases in units moved within private label subcategories last summer were seen in outdoor grilling items (8.4%) and party supplies (8.5%). But when it comes to ice and beer, consumers largely favor branded products. We saw an increase in units moved for both subcategories — 19.8% and 13.4% respectively. This trend could be due to the hold that major brands have within those categories and the lack of private label competition. For example, Reddy Ice is reported to own 24% market share of the North American ice distribution market alone. And 78% of the U.S. beer market is held by four firms, as reported by the Guardian.

Overall, brands with a place on the barbecue table should expect increased competition as brands attempt to capitalize on heightened interest in these products. Even if your brand doesn't fall into one of these categories, the competition among traditional products can present an opportunity for your brand to set itself apart. Leverage what makes your brand different and how you can join the summer party by offering non-traditional recipe ideas or providing instructions on how to prepare your item on the grill.

3. Expect the battle between private label and branded products to heat up

The fight between private label and name brands is more prevalent than ever as retailers continue to put more effort behind their own product offerings. Seasonality causes this competition to rise considerably for popular summer staples.

Take frozen treat aisle for example — these products consistently see a spike in the summer months. Our Summer Outlook 2024 uncovered that private label ice cream in 2023 only gained a fractional (0.7%) market share in dollar spend when compared to 2022. But during summer 2024, private label frozen desserts (11.7%) and frozen novelties (3.6%) saw large increases in units moved year over year.

Last year’s changes could be attributed in part to the moves that private label brands made in the frozen treat aisle. One example is Walmart’s newest gourmet food brand, Bettergoods, which launched in April of 2024. Supermarket News reported that 78% of Bettergoods ice cream buyers said they would repurchase and 46% found it a better value compared to other ice cream brands. Grocery Dive highlights even more store brands that made their mark in this category in the summer of 2024. The frozen dessert category is just one example of how private label brands can quickly win over consumers during the summer —especially during times of high price sensitivity — making it critical for brands with popular seasonal products to adapt their strategies.

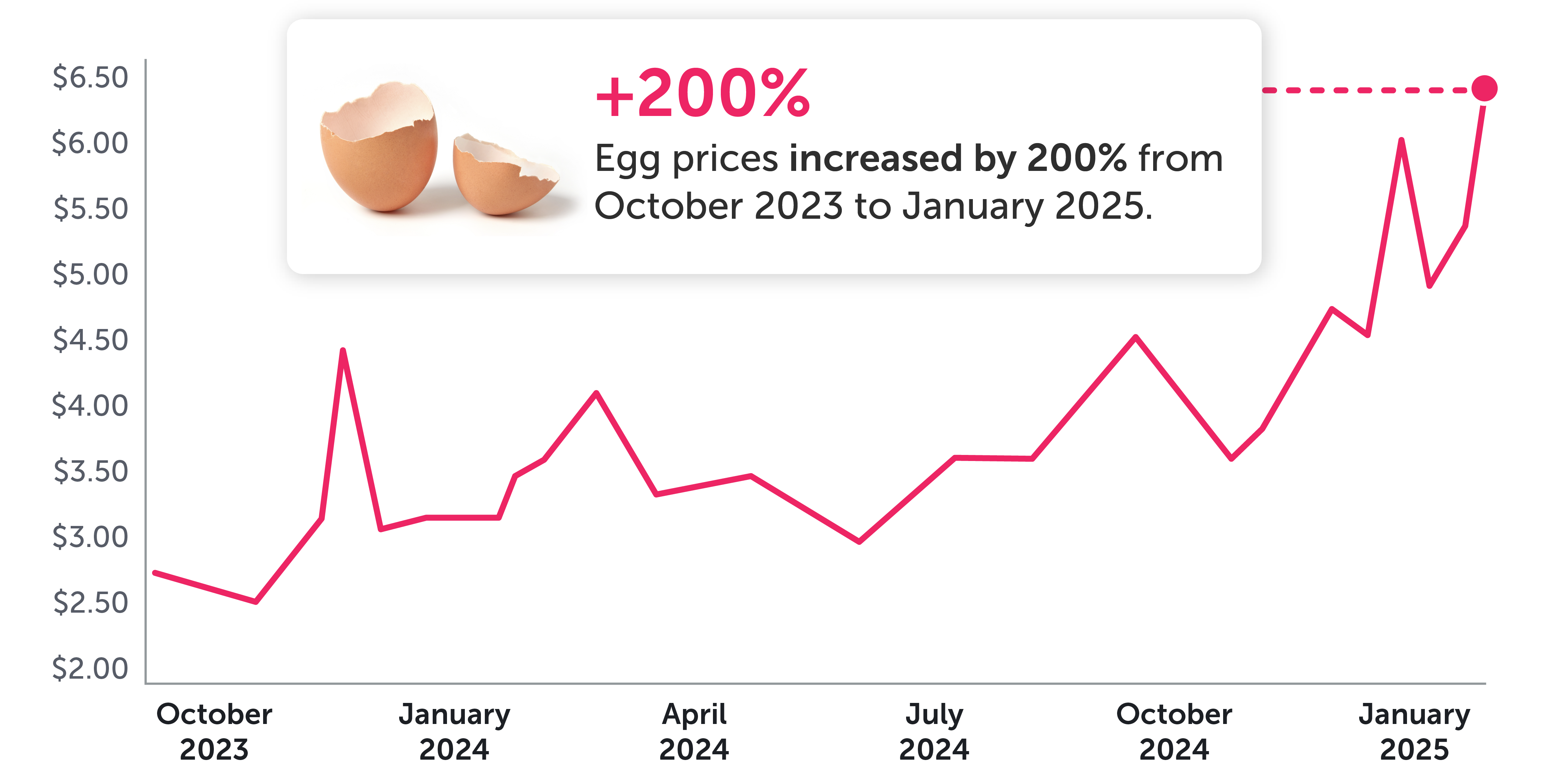

4. The recent rise in egg prices will create an opportunity for breakfast alternatives to capitalize.

Some of the most popular breakfast categories made significant year-over-year shifts in Q1. Units moved for egg substitutes and yogurt each increased by 15% YoY. Plus, when comparing Q1 of 2025 to 2023, we see a 13% increase in units moved for yogurt and 7% for egg substitutes. These high-protein breakfast alternatives certainly benefited from the increased egg prices seen early in the year. Our receipt data showed that the national average cost for a dozen eggs on January 28, 2025 was $5.65, compared to only $3.23 on the same date in 2024 — that’s a jump of 75% in one year. These prices likely increased the popularity of alternative categories in Q1. Although egg prices are starting to drop, higher-than-normal prices are expected to continue into summer 2025.

Private label (+7.9%) and branded (+12.1%) egg products both saw a spike in units moved in the summer of 2024 compared to the year prior. But, with the high egg prices in Q1 of 2025, it’s unlikely these spikes will repeat this summer. This makes this summer a major opportunity for breakfast brands to capitalize on high egg prices as consumers continue to seek more cost-effective options.

5. Grocery shoppers will look for more deals and make their purchases online.

A 2024 report by Brick Meets Click revealed that online grocery sales are predicted to increase more than three times faster than the rate of in-store sales over the next five years. For summer 2024, our data shows year-over-year increases in total sales and total spending for online purchases at grocery retailers that provide both online and in-store shopping options. Online units sold saw a 4.6% increase while spend saw an even larger 7% increase. Consequently, in-store units sold saw a 7.8% dip, and the decrease in total spend was 6.7%. One major retailer saw more drastic shifts, with a 12.2% decrease in in-store units sold and a 6.8% increase in online units sold. Despite the increase in share of purchases for online sales, in-store purchases still took up the vast majority of these purchases.

When the same group of 1,400+ Ibotta app users were asked what money-saving strategies they look to put into practice for the summer, the top answer was looking for cash back savings more regularly (74%). Plus, 64% of respondents said cash back savings are more important to them in the summer months.

This heightened interest in cash back presents a significant opportunity for brands to engage with consumers through digital promotions platforms. Given the continued growth of online shopping, utilizing digital channels to offer cash back is a highly effective way to reach and resonate with summer shoppers. By incorporating cash back offers into their summer marketing strategies, brands can not only attract new customers but also foster loyalty among existing ones, driving sales and boosting brand awareness during this key shopping season.

6. Consumers will prioritize grocery essentials and cooking their own food.

Some of the top money-saving strategies found in the survey of Ibotta app users include making less impulsive purchases (60%), cooking more meals at home (59%), and focusing on necessities only (41%). Diving even deeper uncovered that the top two categories in which surveyed consumers expected to spend more during the summer months were fresh produce (+56%) and healthier meal options (+46%), while they expected to spend less on ready-to-eat meals (-8%). A survey from the National Frozen & Refrigerated Foods Association also uncovered that 81% of consumers cook more than half of their meals at home.

With consumers prioritizing making healthier meals and focusing on necessities while being highly price sensitive due to economic factors, brands can emphasize their place in home cooking and grilling. Providing recipe inspiration and budget-friendly meal-planning tools can be a great way to enter your brand into the cooking conversation. Also consider offering value-added promotions by bundling offers or providing BOGO deals to incentivize consumers to choose your brand over private label.

7. Unexpected CPG trends will emerge this summer, making it critical for brands to be nimble.

Each season, new trends emerge that are impossible to predict. Therefore, it’s extremely important for brands to adapt quickly and not solely rely on assumptions about which tactics will drive incremental sales. Ibotta is changing the game by providing reliable measurement, delivered in near-real time, allowing brand managers to run their businesses like true performance marketers.

Innovations in Ibotta’s rolling measurement of incremental sales allow brands to rethink how they allocate resources and maximize the efficiency of every dollar they spend. This, in combination with the 200M+ consumer reach of the Ibotta Performance Network, allows brands to make an impact this summer and beyond.