December 20, 2021

American life was transformed in March 2020 when the COVID-19 pandemic was declared a national emergency. Lockdowns forced the country to quickly learn new ways to work, attend school and socialize. As the U.S. continues its recovery, the pandemic’s impact on the economy and consumer behaviors will resonate for years to come.

Ibotta was one of many companies that adapted fast to the dramatic impact of COVID-19. When the pandemic hit and the CPG industry turned its focus to e-commerce, we quickly developed the ability to track whether Ibotta users were making their purchases in stores or online. Beginning in May 2020, we were able to use verified purchase data to monitor shifts in buying behavior, observing a meteoric spike in online grocery purchases consistent with other industry data.

According to the U.S. Census Bureau, Americans purchased $7.3 billion worth of food and beverages online in the fourth quarter of 2020, a 125% increase from the same period in 2019. Top retailers that had viewed online grocery as a long-term investment found it paying off almost overnight. Kroger CEO Rodney McMullen said during a September 2021 keynote presentation at Groceryshop that his company experienced three years worth of anticipated e-commerce growth in only two weeks.

Our proprietary data showed that many shoppers who bought groceries online during the pandemic have continued that behavior but that online sales have declined. Investing in true omnichannel strategies has only become more important to serve shoppers where they are as the pandemic continues to disrupt behaviors and supply chains.

The Rise of the Online Shopper

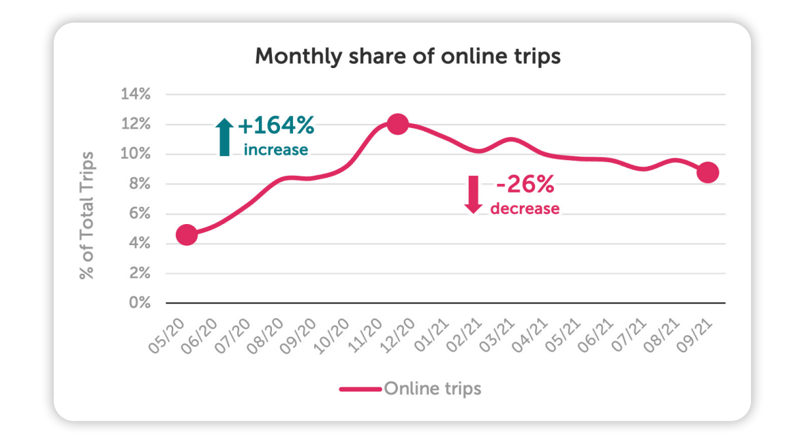

Ibotta’s proprietary data gathered from May 2020 through September 2021 shows how COVID-19 cases affected online grocery shopping and that most consumers that made an online purchase since the start of our tracking have repeated the behavior. In July 2020, approximately 6% of grocery shopping trips were conducted online, but that number increased 80%, to about 12%, in fall 2020 as cases surged. When vaccines became widely available in spring 2021, online shopping saw a 26% decrease, leveling out at about 9% of trips in September 2021.

The continued lift in online trip share is due to the fact that many shoppers who tried grocery e-commerce due to safety concerns have enjoyed the convenience and time saving the service provides. Trying online grocery requires learning a new technology and creating an account with an online retailer. Those inconveniences might have deterred shoppers who didn’t have a strong reason to shop from home. Once consumers navigated those barriers out of necessity during lockdowns, it was easier for them to make future purchases.

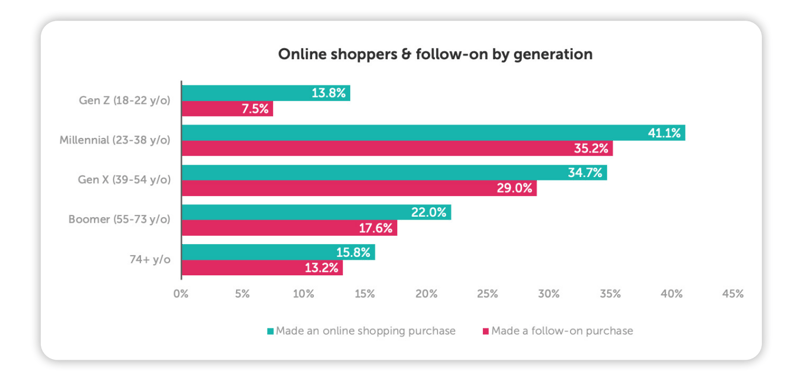

Ibotta data, based on self-reported birth years, found that Millennials and Gen X were most likely to shop online and make follow-up purchases, but the technology was embraced across generations. About 41% of Millennials made an online shopping purchase, and just over 35% of Millennials made a follow-on purchase online. Gen X was close behind with slightly under 35% buying groceries online and about 29% making a repeat purchase.

Boomers and shoppers 74 and older tried online shopping at lower rates, about 22% and 16% respectively, and were also less likely to make a repeat purchase. Gen Z were the least likely to make online grocery purchases at all or to repeat the behavior. These digital natives have huge purchasing power and are more likely to embrace mobile and social commerce. The fact that they have low rates of grocery ecommerce can be partially attributed to their current life stage, with many still living at home or in college dormitories. However, the particularly low rate of follow-on purchasing demonstrates that the generation that grew up expecting the efficiency of Amazon won’t tolerate disappointment. A study by the Retail Feedback Group found that Gen Z consistently expressed more dissatisfaction with online grocery purchases made during 2020 than any other generation, expressing particular frustration with the functioning of retailer websites and apps and the online checkout process.

Buying Across Channels

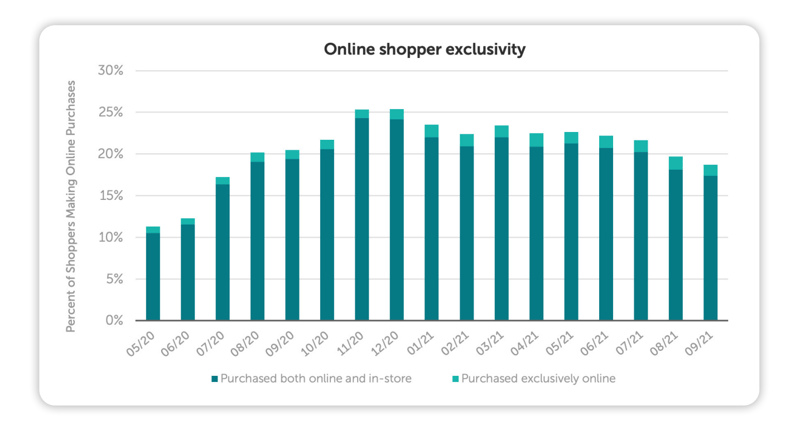

While the pandemic drove greater adoption of grocery e-commerce by consumers, few shoppers made all of their purchases digitally. The number of Ibotta users making some of their purchases online rose from about 10% in May 2020 to a peak of near 25% in November and December 2020 before dropping steadily to a new post-pandemic low of around 18% by September 2021. However, the number of shoppers making all of their purchases online remained relatively stable throughout that time period, only ever amounting to a few percentage points.

Retailers and brands face a variety of challenges to maintaining their online grocery momentum. Supply chain issues can be particularly frustrating for e-commerce shoppers if they result in delayed or cancelled deliveries or unwanted substitutions. According to an October 2021 report by the Path to Purchase Institute and Edge Marketing, shoppers also tend to prefer to purchase perishable products such as produce and meat in stores, where they feel they can better guarantee freshness. The same study found that when those categories are purchased online, it’s typically for curbside pickup rather than home delivery since shoppers are concerned about those products remaining refrigerated.

As COVID-19 cases decline and offices reopen, shoppers are likely to return to some of their pre-pandemic shopping habits. Savvy marketers will devise omnichannel solutions, selling products for direct delivery, curbside pickup and in stores to meet shoppers according to their preferences based on category, routine and the state of the pandemic.

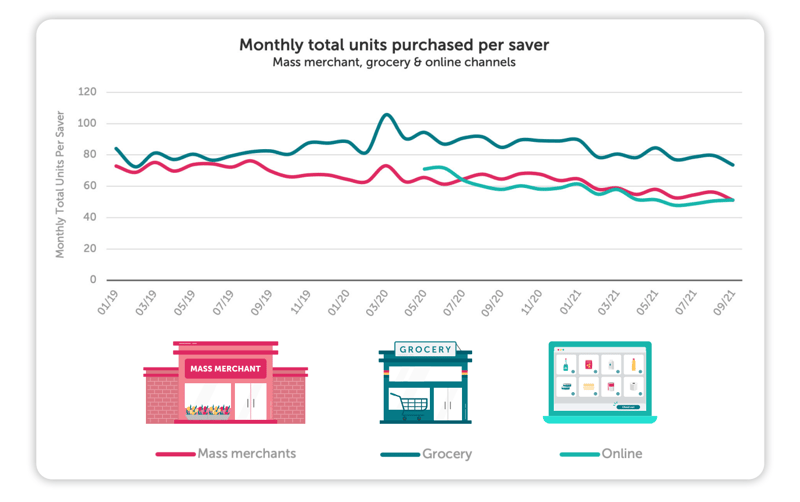

The pandemic didn’t just increase online shopping but also significantly impacted sales at brick-and-mortar stores. Both grocery stores and mass merchants saw significant surges in the quantity of SKUs purchased by Ibotta users in March 2020 as shoppers stocked up before lockdowns. That flurry of activity was immediately followed by a steep decline in sales. While grocery purchases have largely leveled off, they remain lower at mass merchants compared to the channel’s pre-pandemic rates.

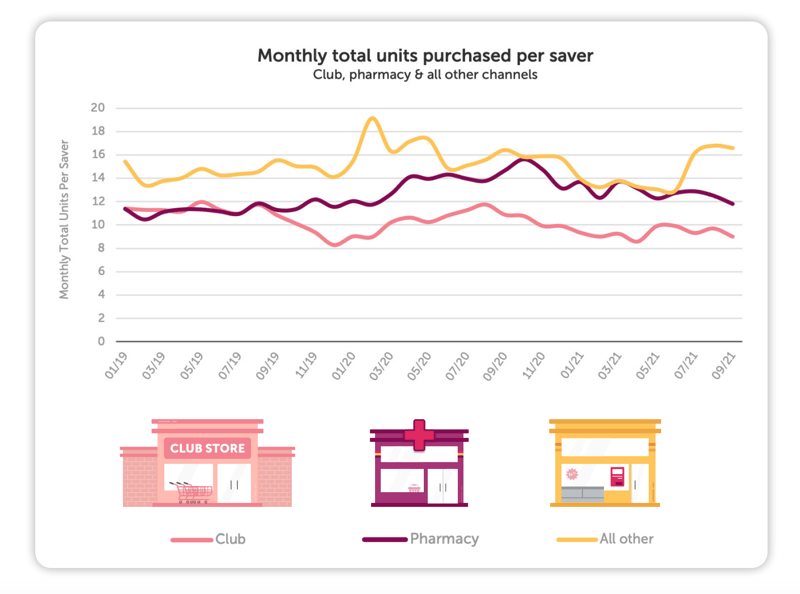

Online sales peaked in May, ebbed and then rose again during the fall surge, and dipped further following the widespread rollout of vaccines. The percentage of purchases Ibotta users made at pharmacies, club stores, convenience stores, dollar stores and liquor stores from January 2019 through September 2021 remained relatively consistent, with pharmacies and liquor stores experiencing the most significant growth.

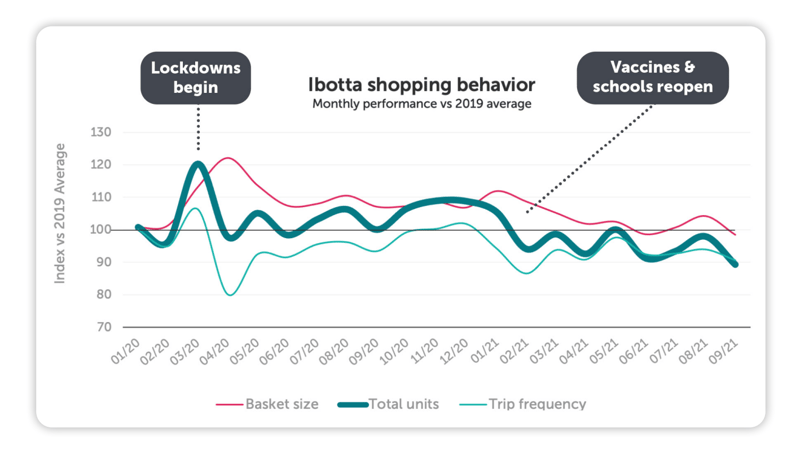

The pandemic also appears to have had a lasting impact on how much shoppers buy. When lockdowns hit in spring 2020, shoppers rushed to stores and filled huge baskets to stock up. In March 2020, panicked shoppers lined up outside of grocery stores before openings in an attempt to buy meat, toilet paper, bread and other staples that were in short supply. Ibotta research found trip frequency then experienced a dramatic decline versus the 2019 average. While frequency briefly returned to pre-COVID numbers before the fall surge, trips have since declined again and were still only about 90% as frequent as their 2019 numbers as of September 2021.

Basket sizes remained elevated until the beginning of summer 2021, evidence that shoppers were likely continuing to try to avoid exposure to COVID-19 by making fewer, larger trips. However the total units savers purchased each month dipped overall beginning in February 2021. The timing coincides with schools reopening and vaccines giving consumers the confidence to return to restaurants, both of which resulted in a reduced need for groceries.

CPG brands and retailers should be concerned about the overall decline in grocery sales since the height of the pandemic. A survey conducted by CPG sales and marketing firm Acosta in March and April of 2021 found that 92% of families planned to continue to eat at home at least as often as they did during the height of the pandemic and two thirds of those surveyed said they cook and eat far more meals at home than they did before March 2020. Brands and retailers should try to build lasting gains with these shoppers, which will involve meeting their needs for affordable meal solutions no matter how they choose to shop or how much time they have as work and school schedules change.

Shopper Sweet Tooths

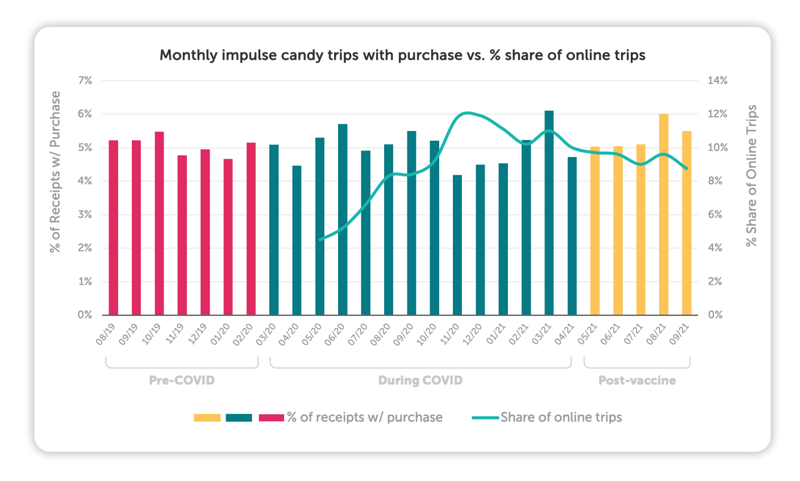

One indicator that in-store trips were returning came from impulse shopping trends. Ibotta analysts tracked the percentage of receipts each month that included gum, mints, chocolates or other sweet snacks in packages of three-ounces or less — which are most likely to be added to baskets while shoppers are waiting in store checkout lines.

Those transactions experienced the most significant declines in April 2020, the first full-month of COVID data, and as the fall surge gripped the U.S. in November 2020. However they leapt to record highs in March 2021 as vaccinated shoppers returned to stores and seemingly celebrated with a little indulgence.

The ebbs and flows of impulse confectionery purchases are almost directly correlated with the percent of transactions shoppers were making online. They remain soft compared to pre-pandemic levels, an indication that brands will need to rethink their customers’ path to purchase and find ways to replicate the impulse shopping experience online.

The Economics of COVID

COVID-19 triggered the worst economic downturn the U.S. has experienced since the Great Depression. According to the Pew Research Center, U.S. unemployment reached 14.4% in April 2020, worse than the Great Recession’s peak of 10.6% but still significantly less than the estimated 25% unemployment that occurred during The Great Depression.

During the Great Recession, multiple reports showed shoppers looked to save money by increasing coupon use and turning to private label products. However, the uncertainty and supply chain disruptions caused by COVID-19 changed the impact. CPG brands and retailers paused everything from media buys to coupon programs in spring 2020 as they grappled with supply chain issues and panic buying that caused out-of-stocks in key categories, pushing many retailers to implement purchase limits on products such as toilet paper and eggs. These disruptions have continued through late 2021, resulting in higher prices and fewer promotions according to an October 2021 IRI study.

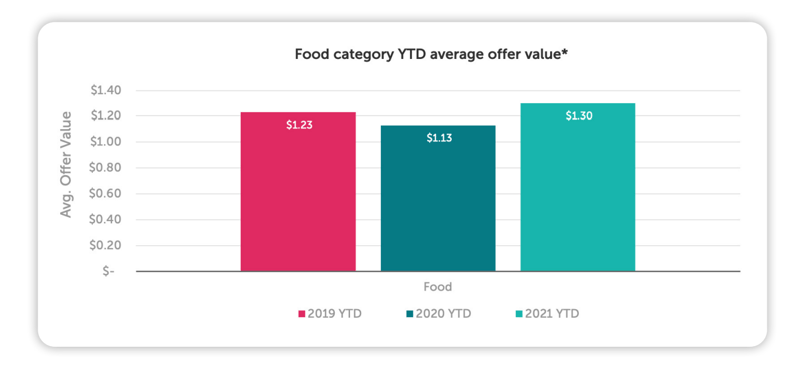

Yet brands that reduced their promotions last year have been returning to funding Ibotta offers as they seek tactics with proven ROI. While the average Ibotta offer in the food category dropped in 2020 to an average of $1.13, average offer value has since not only rebounded but exceeded the 2019 average of $1.23. The 2021 average of $1.30, a 5.7% increase since 2019, demonstrates that brands have a renewed appreciation for the value of Ibotta rebates in enticing new consumers and maintaining their loyalty in a competitive and volatile retail environment.

Sometimes the data contradicted the behaviors that might have been expected during an economic downturn. Early in the pandemic, there was some expectation that shoppers would turn to private label products as a way to save money or as a substitute for a favorite brand that was sold out. However, the amount of private label products Ibotta users purchased has remained constant from 2019.

Our findings are backed up by publicly available NielsenIQ data, which showed that even cash-strapped shoppers didn’t contribute to private label growth because they were actually seeking novel products and ingredients that could alleviate boredom they felt during lockdown. Private label products might have experienced more growth if not for supply chain issues that national brands were able to somewhat mitigate by adjusting their assortment to focus on their most popular SKUs.

A Constantly Shifting Landscape

While the parameters of this report ended in September 2021, we are already predicting new stages in the pandemic will continue to impact shopper behavior. The rise of the Delta variant slowed office reopenings, preventing a return to pre-pandemic routines. Meanwhile, retailers and CPGs are continuing to struggle with supply chain issues and staffing shortages, with retail job openings reaching 1.2 million in July 2021 compared to 876,000 last year according to the Bureau of Labor Statistics.

Consumers are facing new economic challenges due to the end of expanded unemployment benefits for an estimated 7.5 million people in September. While the end of those benefits was meant to bring people back into the workforce, so far it’s had little impact. According to the New York Times, the labor force shrank again in September and there are 5 million fewer people working than before the pandemic and 3 million fewer looking for work. The Washington Post reports that nearly 1.6 million mothers of children under 17 have not been able to return to work because they can’t find stable childcare as a combination of staffing shortages and outbreaks among unvaccinated children have reduced the number of spots in daycare and afterschool programs.

Ibotta will continue to monitor these trends as they evolve, using our verified purchase data to provide snapshots of changing shopper behaviors across all channels. Reach out for a demo on how we can help you learn more about your customers and grow your business.

![]()

Achieve your brand goals

Which metrics are most important for your brand? Get in touch to explore possibilities with the Ibotta Performance Network.