October 7, 2025

In part two of our 2025 Holiday Outlook series, we dive deeper into our annual study of over 1,500 holiday shoppers. The results are eye-opening, uncovering that shoppers are budget conscious but willing to spend, loyal yet open to switching brands, and cautious yet seeking meaningful experiences. Here are 8 key stats that should shift how you approach the holiday season and why performance-driven promotions are your competitive advantage.

1. Anticipated holiday spending remains virtually unchanged

Anticipated holiday spend remains virtually flat this year at $847.99, a minimal increase from last year's $845.10. While budgets appear stable, 61% of shoppers cite inflation as a top concern, meaning their dollars aren’t going as far as last year. Expect shoppers to be more prudent with their purchases this year.

2. Openness to trying new brands is up 10 percentage points over last year

As a direct consequence of shoppers prioritizing value, openness to trying new brands has increased significantly over last year (55% in 2025 vs. 45% in 2024, a 10% point difference). For small and emerging brands, this is a massive opportunity to drive brand trial and customer acquisition. The key motivator is attractive discounts or promotions, cited by 63% of shoppers as the most significant reason to try new products. But product reviews and recommendations from others hold a lot of weight as well. This underscores the power of providing compelling offers to capture the attention of a consumer base that is actively looking for a reason to switch.

3. Self-gifting is down 12 percentage points

As consumers focus on managing their budgets, the data shows a double-digit percentage drop in shoppers buying gifts for themselves – down from 35% in 2024 to 23% in 2025. This shift is accompanied by a continued desire to give meaningful gifts to others. On a semantic scale, consumers prioritize finding unique or personalized gifts over those that are easy to find (58% to 24%). This creates an emphasis on intentional gift giving during a cautious economic climate.

4. Only 39% of shoppers plan to buy holiday decor, prioritizing what they need most

Consumers continue to prioritize essential items as a money-saving strategy this holiday season by reducing their emphasis on decorative items. The purchasing of holiday decorations and seasonal household items is expected to decrease, with only 39% of shoppers planning to buy these items, down from 56% in 2024. This trend is a clear signal that consumers are prioritizing practical, necessary purchases over new decorative items this year. Brands in this vertical should focus on demonstrating exceptional value through promotions to attract the smaller pool of interested buyers, and even change the minds of those who plan not to make those purchases.

5. Less than 1% of shoppers will cut back on food purchases for the holidays

6. 86% of consumers will do the majority of their shopping in November or December

Our previous Holiday Outlook revealed that the majority of holiday shopping will occur within a shorter window. 86% of consumers will do the majority of their shopping in November or December, with a large surge in December (40% vs. 27% last year). And that’s a strong signal for brands to adjust their promotional timing. While some shoppers will get started early to reduce stress – as one-third will at least get started by the end of September – the vast majority will wait.

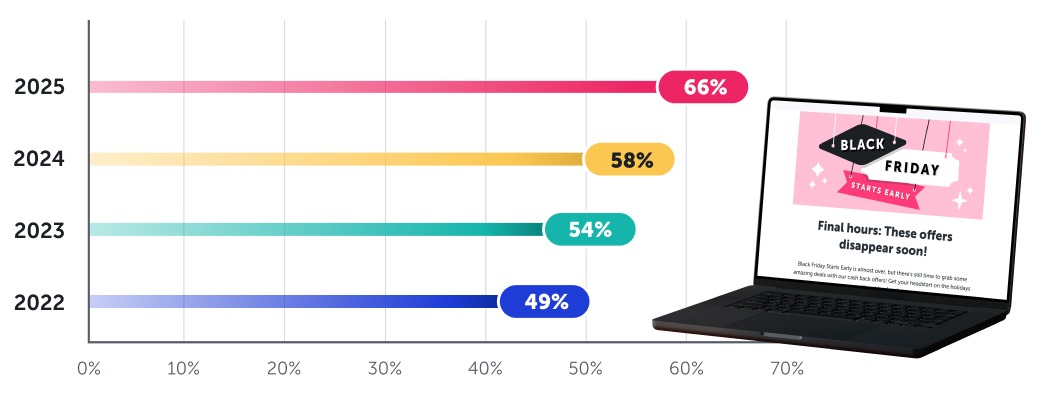

7. Two-thirds of shoppers plan to use Black Friday as a savings tool

One reason shoppers wait until November and December to shop is to capitalize on big deal days. Black Friday is no longer just a shopping event; it is a critical budgeting tool for most shoppers. Two-thirds (66%) of shoppers plan to use Black Friday as a savings technique, up from 58% last year. It has consistently been rising in importance each year since we started tracking it in 2022. One-third (32%) cite it as the best savings event, which is a significantly higher figure than those who identify Cyber Monday (14%) or Prime Day (11%) as the best savings event.

8. Ads highlighting deals are 47% more likely to grab the attention of gift-givers

Shoppers are looking for value, but they also seek authenticity. Our research shows that ads that highlight money-saving deals and offers are the most likely to grab attention (47%). However, ads that are also highly relevant to a shopper’s interests (39%) and from brands they already trust (35%) also play a pivotal role. This suggests a need for an advertising strategy that combines compelling value with trustworthiness and personalization, ensuring that your promotional efforts resonate with a consumer’s mindset.

.png)

.png)