September 19, 2024

With the holidays fast approaching, now is the time for brand marketers to craft revenue-driving strategies that will help them end the year strong. Yet keeping up with consumers’ ever-changing habits and preferences isn’t easy, particularly in light of the continued pressures of rising costs and inflation. To maximize the performance of your promotional strategies and keep your brand top of mind with consumers, it’s important to have the latest data at your fingertips.

Lucky for you, Ibotta is here to help. We surveyed nearly 2,000 consumers who are actively using our app to better understand their plans for the approaching holiday season, how and where they plan to shop, and what products they’re putting on their lists.

While we expect to see greater stability in regards to how much people plan to spend this holiday season — an average of $845.10 — plenty has changed since 2023. The trends we uncovered shed light on what will influence consumer behavior in the months ahead, giving marketers like you an edge as you develop your holiday promotional strategies.

Top 10 Holiday Shopping Trends for 2024

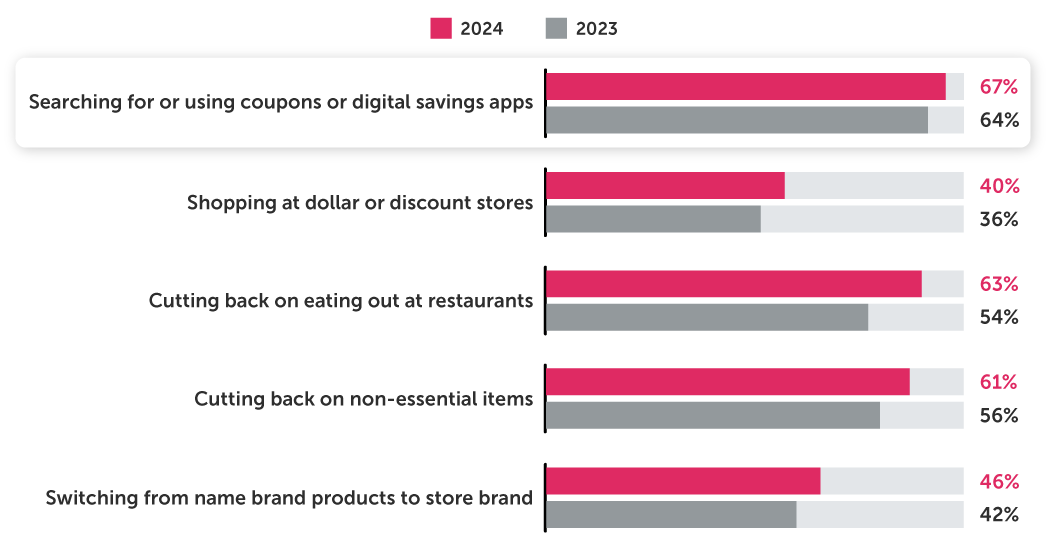

1. Consumers are cutting back to combat inflation.

Inflation remains a top concern for consumers and continues to shape their shopping habits. When we asked Ibotta consumers what they’ve done over the last three months as a direct result of increased costs, we saw notable increases in the number of people who said they shopped at discount stores, cut back on restaurant spending and non-essential items, and switched to store brands. Additionally, 67% of consumers said they searched or used coupons or digital savings apps.

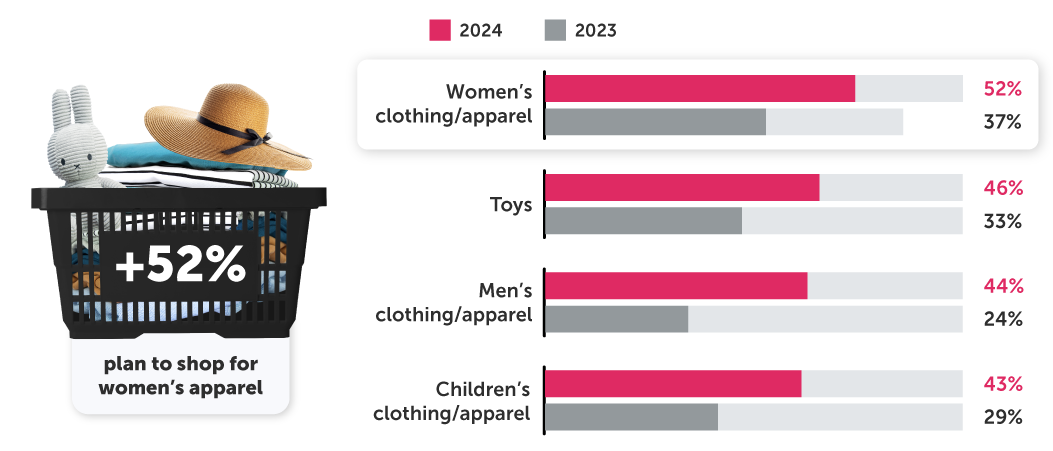

2. Apparel and toys are at the top of consumers’ holiday shopping lists this year.

The categories Ibotta consumers are planning on shopping for this year have changed significantly since 2023. Last year, the top three categories consumers were shopping for were food and beverages; gas, fuel, and convenience stores; and personal care products. But this year marks a shift toward general merchandise products, with toys, footwear, and women’s, men’s, and children’s clothing and apparel all making it onto more holiday shopping lists.

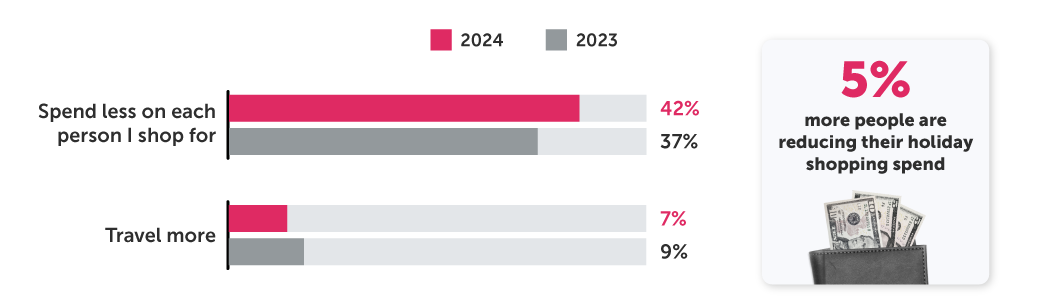

3. More consumers plan to stay home and spend less on each person on their shopping list.

Inflation will continue to affect consumer behavior as we enter the holiday season, with many people exploring new ways to save money and stretch their budgets further. When asked what they’d be doing differently this year, 42% of consumers surveyed said they plan to spend less money on each person they’re shopping for and only 7% of people said they plan to travel more.

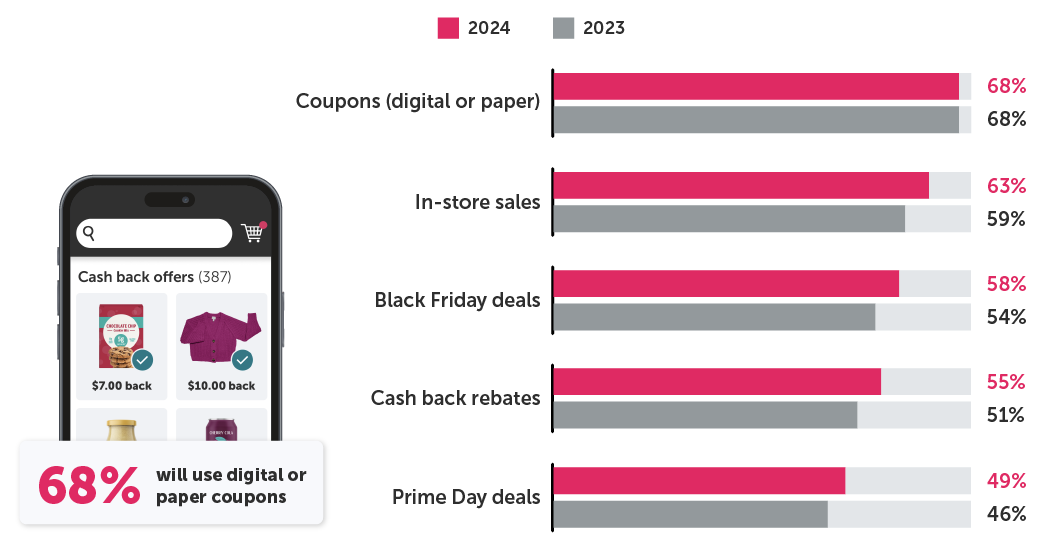

4. More shoppers are looking to cash-back rebates and big sales for holiday shopping, but coupons still reign supreme.

Ibotta consumers are always on the hunt for a good deal, especially during the holiday season. This year, we saw a 4% increase in the number of people who are turning to cash-back rebates to save money. There was also a noticeable jump in the number of consumers planning to shop big deals on Prime Day, Black Friday, Cyber Monday, and during in-store sales. But despite these shifts in money-saving tactics, coupons held onto the number spot, with 68% of consumers surveyed saying they expected to use either digital or paper coupons this holiday season.

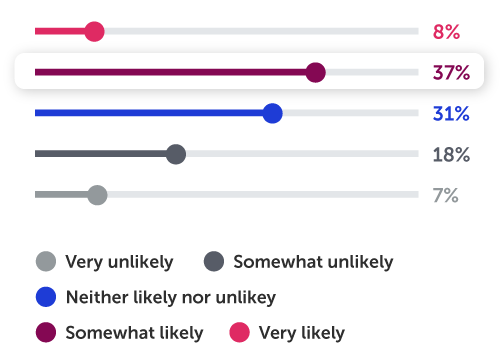

5. Samples, coupons, and cash back are the keys to driving brand trial this holiday season.

Convincing consumers to give your product a try is often half the battle, but that doesn’t mean they aren’t willing. When shopping for the winter holidays, 45% of consumers said they’re somewhat or very likely to try new products. This presents a big opportunity for marketers looking to drive brand trial. The key is leveraging effective tactics that actually influence those purchasing decisions. And at the top of consumers’ lists? Coupons, cash back, and free samples.

6. Consumers are doing their cooking and baking from scratch this year.

Looking at the most commonly bought food and beverage items for the holidays, it’s clear that Ibotta consumers plan to do most of their cooking and baking themselves. The top four foods and beverages people typically purchase for the winter holidays include baking products, dairy and eggs, fresh produce, and meat, seafood, and poultry.

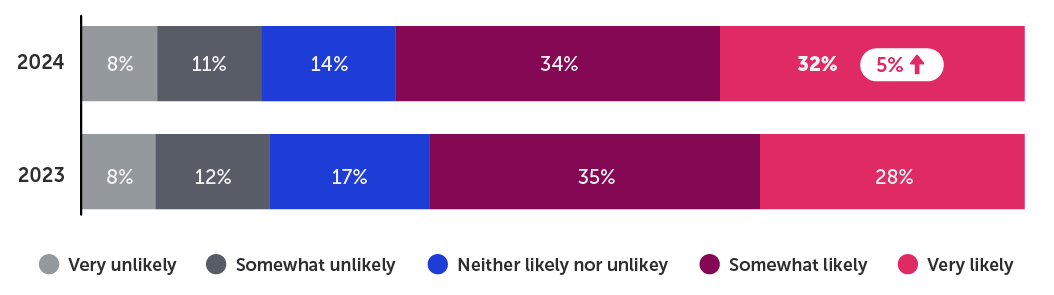

7. Dollar stores are becoming a go-to for holiday decor.

Dollar stores have long been a popular destination when shopping for holiday decor, and that trend is on the rise this year. Of the consumers we surveyed, 32% said they were very likely to shop for holiday decorations at the dollar store — up from 28% in 2023. This highlights the increased importance of the dollar channel this holiday season.

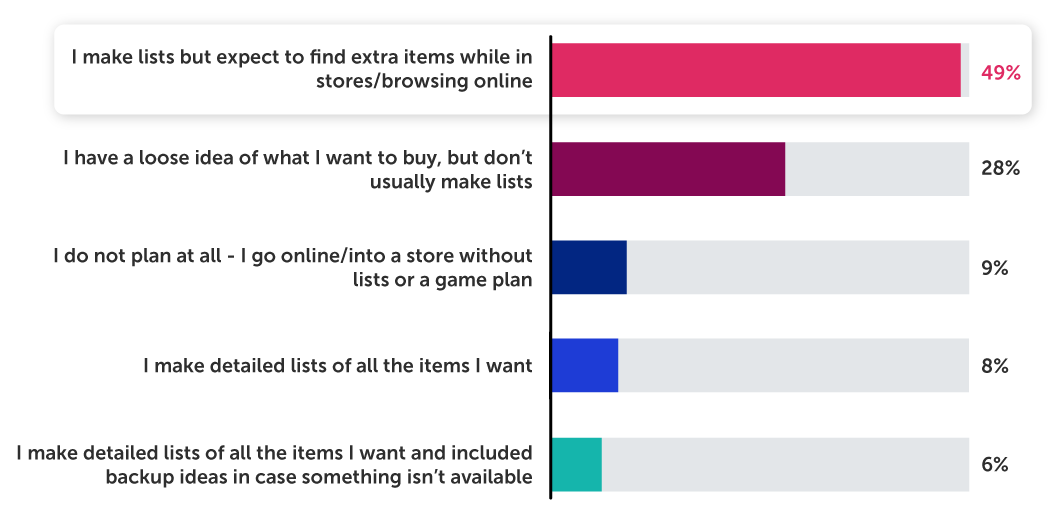

8. Shoppers are making a list, checking it twice — but also making purchases they didn’t plan for.

Getting on consumers’ holiday shopping lists before they hit the store can help ensure a brand’s products make it into their basket at checkout. But finding ways to stand out in the aisle and online is important too. Nearly half of Ibotta consumers said they make lists but expect to find extra items while in stores or browsing online.

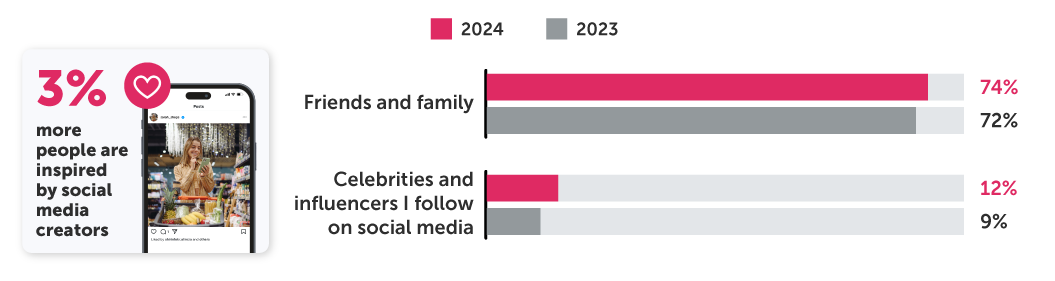

9. More consumers are turning to celebrities and influencers for holiday shopping inspiration.

While friends and family continue to be the top source people count on for holiday shopping inspiration, influencers and celebrities on social media have more sway over consumers than ever. This year, 12% of Ibotta consumers cited social media creators as a source of inspiration, up from 9% in 2023. And while these numbers may seem low compared to other, more traditional sources, they underscore the growing importance of influencer marketing for brands.

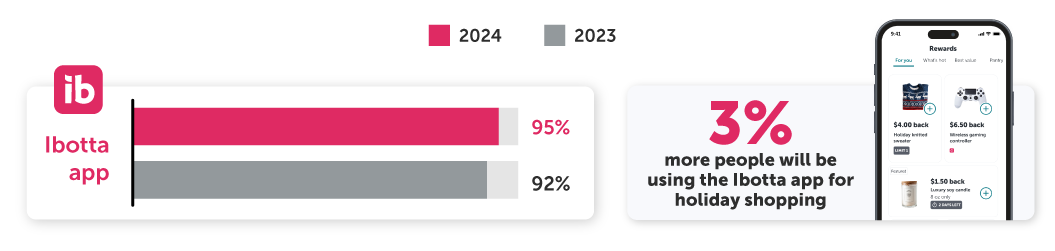

10. More Ibotta consumers plan to use the Ibotta app this year.

OK, so it’s no surprise that consumers who actively use our app also use it for holiday shopping. But even among this dedicated group of consumers, we saw a 3% increase year over year in the number of people who expected to use the Ibotta app this holiday season. If you’ve been waiting to launch a promotion on the Ibotta Performance Network, consider this your sign to get started.