December 4, 2023

2024 signifies a pivotal moment for brands and their retail partners. In addition to being a presidential election year of media-frenzied noise, shopper spending habits are shifting markedly, private label is making waves, and hyper-efficient tactics are emerging.

In the second half of 2023, consumers’ store visits fell 9% year-over-year (YoY), contributing to a 10% drop in units sold compared to the same period in 2022.1 These declines underscore the need for industry leaders to adapt, and the optimal strategy to overcome these declines involves a focus on delivering outstanding value and fostering innovation — at immense scale.

In this article, we reveal bold predictions and strategies to maximize store visits, drive incremental sales volume, and overcome key challenges facing marketers in the year ahead.

Opportunities for Retailers

What is the biggest opportunity for retailers in 2024?

In 2024, retailers should double down on delivering and communicating value to maximize online and offline store visits. In the current inflationary environment, shoppers are increasingly seeking value. Despite YoY store visits declining — a sign of inflation impacting purchasing power — shoppers are now visiting twice as many different stores as they were 10 years ago,2 and 54% say they would change stores to find savings.3 This trend of heightened value-seeking and channel shifting highlights a challenge: retaining the same percentage of a shopper’s basket is becoming increasingly difficult.

For a key competitive advantage in 2024, retailers will need to deliver the savings that shoppers are looking for and expect to receive through personalized, targeted offers — on staples, new items, and their favorites — helping to drive repeat trips, increasing traffic, basket sizes, and easing the burden of prices rising over the last few years.

How will retailers innovate their digital offer programs?

While market fluctuations are inevitable in 2024, retailers should stay proactive — optimizing their digital offer programs to deliver the greatest amount of shopper value possible.

One quick way retailers are optimizing their digital offer programs is by providing shoppers with more options. This can include more offers across a shopper’s existing basket, offers that are more adjacent to existing purchases, or others that are identified as relevant, as well as entirely new items that fit with their buying habits.

The way retailers are achieving this is by providing shoppers with more than 6X the volume of national offers available, compared to Ibotta’s closest competitor. Through the IPN, retailers can promote over 1,000 national CPG offers and more than $2,500 in daily savings on their properties. Cash back offers can be used to establish a digital wallet where logged in customers can bank their rewards and use them to save on future purchases in stores and online, or use them on their next shopping trip.

Incorporating digital offers into retail media placements drives better advertising and offer performance by combining the targeting abilities of retail media with the monetary incentive of digital offers. Brands are excited to leverage these tactics in concert to maximize return on investment. The continued personalization improvements on retail media properties will improve performance and drive incremental sales, bounceback trips, and customer loyalty.

Furthermore, while retailers have traditionally used digital identification at checkout, there are two key emerging trends reshaping this practice. First, the advancement of retailer data ecosystems is providing greater opportunities for retailers and brands to leverage consumer data tied to digital identification. Additionally, major retailers who historically may not have required digital identification are increasingly adopting this approach.

Catering to consumer expectations by providing promotional incentives at multiple touchpoints will only become more crucial to influencing shopper behavior along the entire path to purchase in 2024.

What's next for private label?

There has already been an unprecedented shift to private label purchasing in recent quarters. On some private label products, sales outpaced their national brand competitors by more than 5X. On average, the growth rate for a randomized private label sample was 2.3X that of their national brand competitors.4

Consumers were encouraged to try private label alternatives due to inflationary pressure, but many have found those products to exceed their quality expectations — private label brands are sticky. In fact, 76% of shoppers who switched from a national brand to private label in 2023 purchased a private label product in the same category on their next trip.5

Given this landscape, retailers face a promising opportunity to shore up store visits with their private label offerings, capitalizing on shifting consumer preferences, while national brands must now navigate the challenges of innovating and recapturing consumers.

Opportunities for Brands

What are the biggest opportunities for brands in 2024?

Ibotta data shows that 106 categories experienced private label switching where shoppers moved from branded products to private label items, across a 12-month period from early 2022 – 2023. Brands will need to win back shoppers from private label through promotions that drive efficient revenue growth from incremental sales and repeat purchases.

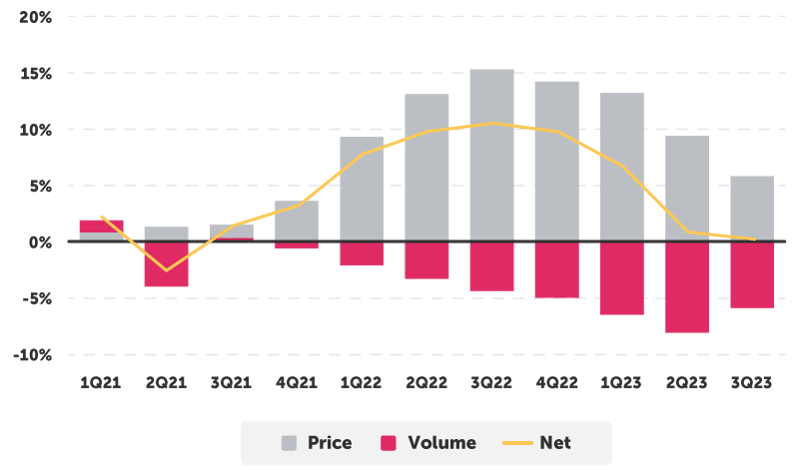

As brands have relied on pricing strategies to fuel both revenue and margin growth, declining volume and market share are now offsetting these efforts. Thus, it's imperative to focus on promotional strategies that accelerate sales volume and overall profits.

In the chart below, see how the pricing actions of a multinational food & beverage manufacturer led to volume declines that offset net gains.

YoY Quarterly Sales Growth (US)

(Of a leading Food & Beverage Manufacturer)

The General Merchandise landscape will experience a transformative shift in 2024 with the surge in digital offers. Inefficient and non-incremental legacy tactics such as mail-in rebates and unnecessary mark-downs are being replaced with more efficient, flexible solutions, where brands no longer experience low redemption rates, administrative costs and MAP (minimum advertised price) limitations. Manufacturers that invest in Retail Media Networks can now combine greater brand visibility with strong offers that increase conversion.

The strategic deployment of digital offers, coupled with a precise grasp of incrementality, is revolutionizing the game for home appliances, baby products, toys & games, electronics, and pet supplies by offering the ability to drive significant incremental volume at a more efficient return on investment compared to other media tactics. These brands are seizing a coveted first-mover advantage through the strategic use of IPN offers, collaborating with major retailers like Walmart and Dollar General to drive efficient revenue growth.

Advertisers on the IPN average a 50% lift in incremental units sold, with 42% of conversions being new-to-brand, and a 7X return on ad spend (ROAS).

How will brands innovate their digital offers to maximize results with retail partners?

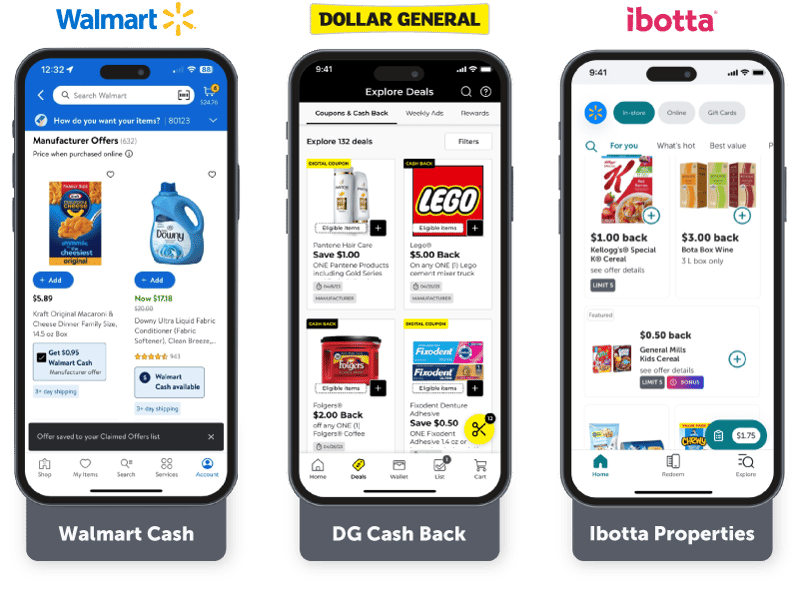

In 2024, brands will make the shift to pay-per-sale promotions vs. pay-per-clip to drive YoY growth with key retailers like Walmart, Dollar General, Kroger, and more. The rollout of DG Cash and manufacturer offers at Walmart marks a critical innovation and strategic opportunity for brands to re-think legacy tactics and evolve with the expectations of consumers and the ever changing promotional landscape that they operate within. Ibotta’s AI-driven network represents a major opportunity for brands to reach 91% of American households6, unlocking measurability of spend and ROI at unprecedented scale.

Shoppers who previously sought paper coupons or online codes now “have a stronger preference for cash back.”7 This trend applies broadly to shoppers overall and is particularly noticeable among a majority of millennials. Brands and retailers are partnering with Ibotta in new ways to maximize this opportunity in 2024. Overall, the IPN has delivered $1.6B+ in consumer savings and rewards.

Aside from promotional incentives, how can national brands remain competitive against private label?

For brands to stay ahead, it’s essential to focus on innovation and distribution. Innovation items and line extensions have historically enabled national brands to compete with private label by creating novelty for consumers — capturing the attention of both their base and new-to-brand shoppers.

What’s one key piece of advice for CPG brands?

The inflation pinch is real for the American consumer. Amidst rising costs hurting shoppers, as well as competition for their attention, brands must effectively reach as many consumers as possible with timely, relevant offers to drive efficient revenue growth.

Three years ago, if an average American shopper visited the grocery store 52 times annually and rang up 20 items each trip, today they're visiting the store less than 48 times and ringing up only 18 items on each trip. This means fewer dollars and tougher choices. And the prognosis is not necessarily positive. Morgan Stanley predicts consumer spending to slow more in 2024 and 2025.8

Plus, the "grow through price" door is closing, as stated by Walmart CEO Doug McMillon and reported by Fortune.⁹ As brands turn to price hikes for revenue growth, investing in digital offers can help ease the pain for consumers and provide additional value for retail partners to leverage.

Additionally, millions of Americans rely on the federal Supplemental Nutrition Assistance Program (SNAP) to make ends meet, and the program’s reduction is making it more difficult for consumers to get by. Ahold Delhaize, the multinational retail and wholesale holding company, explicitly acknowledged the program’s reduction, along with higher interest rates and the resumption of student loan repayments in October ‘23, as contributing factors to lower-than-expected margins.10

High costs impact shoppers. They not only affect consumers' choices by potentially steering them toward competing products or causing them to abstain altogether but also emphasize the crucial need for brands to strategically consider every aspect that contributes to the value consumers seek. Adapting to meet consumers ‘where they are’ goes beyond shelf presence; it now requires innovative approaches to ensure that every consumer can fulfill all their needs with a particular brand during a single shopping trip.

CMO Perspective: Marketing and Technology

What may be the greatest challenge CMOs expect to face in 2024?

As consumer spending changes, finding receptive audiences and impact-generating tactics — while continuously measuring performance to understand if you’ve got it right — will be an ongoing challenge.

Ibotta recently surveyed 400 industry professionals across all major grocery retail categories and found that budget allocations are split 50/50 between top- and bottom-of-funnel spend — emphasizing the importance of balancing brand “awareness” and “consideration” objectives with directly measurable tactics for optimal conversion and ROI.

Ibotta’s AI-driven network is making this balance more attainable, accelerating learning curves and enhancing performance marketing effectiveness. By working closely with Ibotta, brands and retailers are activating digital offers across a variety of full-funnel tactics to drive measurable results.

Actionable Steps Forward

Focus on value to drive engagement and loyalty

Given the rise of discerning, price-conscious shoppers and increased switching behavior, brands and retailers must combat declining YoY sales volume by prioritizing digital offers that deliver outstanding value.

Brands are quickly losing market share to private label and facing year-over-year challenges due to declining volumes. By continuing to personalize the retail experience, brands can precisely and efficiently convey their messages, extending offers to the right shoppers at the right time. Whether they’re aiming to drive trial, incremental sales, or repeat purchases and shopper loyalty, they’re optimizing value for all stakeholders involved.

Partner with Ibotta to drive efficient growth

The IPN is the way forward for brands and retailers. It enables them to influence shopper behavior — driving incremental sales, market share gains, and cross-portfolio expansion as part of increased trips and basket sizes.

For Retailers: The IPN partners with 2,000+ leading brands, enabling retailers to access incremental national budgets and deliver more digital offers on a wider range of items.

- 1,000+ offers available daily

- 6X more national CPG offers vs. the leading competitor

- $2,500+ in daily savings to push into loyalty programs

For Brands: With the ability to reach 91% of American households on a pay-per-sale basis via the IPN, brands are unlocking measurability of spend and ROI at unprecedented scale. Advertisers on the IPN average:

- 42% of conversions new-to-brand

- 7X return on ad spend (ROAS)

- 50% lift in incremental units sold

![]()

Achieve your brand goals

Which metrics are most important for your brand? Get in touch to explore possibilities with the Ibotta Performance Network.

Appendix

Ibotta is a leading data source for both incentivized and organic purchases from in-store and online grocery sales across all major US retail channels. Ibotta's first-party SKU-level data provides insights into shopper behavior across 4B purchases annually.

1 Ibotta first-party data, 2023*

2 Coupons in the News, 2023

3 Winsight Grocery Business, 2023

4 Ibotta first-party data, 2023**

5 Ibotta first-party data, 2023***

6 Circana Scan Panel; Total US – All outlets; 52 wk ending Nov 2023

7 Coupons in the News, 2023

8 Morgan Stanley, 2023

9 Fortune, 2023

10 Ahold Delhaize, 2023

*Ibotta tracked monthly store trips and monthly units sold across major key categories for year-over-year analysis. June – October 2023 data showed that, on average, CPG brands were down -9% on store trips and -10% on units sold over the course of those months YoY.

**Ibotta tracked one specific private label spend which grew at 5.1X the rate of its leading national brand competitor over the course of January 1 – October 31, 2023 vs. the same period of the previous year. Ibotta also tracked a sample of randomized sub-categories, finding that private label spend in those sub-categories grew at an average rate of 2.3X their national brand competitors during the same period.

***Ibotta tracked purchase behavior of shoppers who switched from a national brand to private label in 2023, finding that 76% of those shoppers purchased a private label product in the same category on their next trip.