December 13, 2021

One year after the first case of COVID-19 was diagnosed in the United States, the pandemic has fundamentally changed the country’s economy. While the vaccine offers hope that a return to normal is in sight, challenges with the rollout and the rise of new strains continue to create uncertainty about when the crisis will end. Brands and retailers have the opportunity to rise to these unique challenges and create lasting advantages, but it will require an understanding of how COVID-19 has altered the omnichannel landscape and what changes will last beyond 2021.

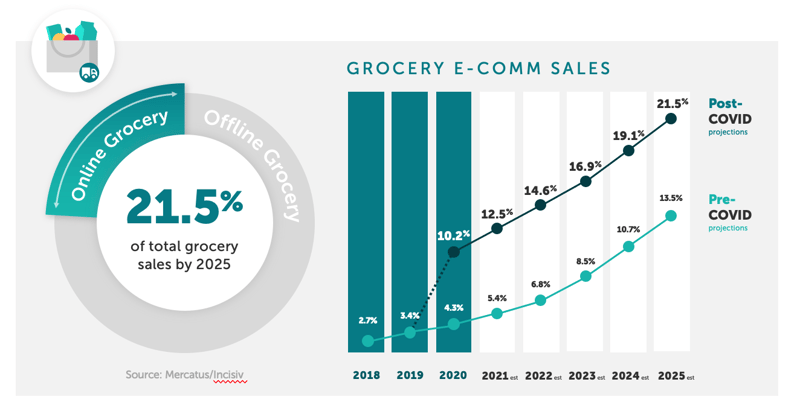

E-commerce grocery shopping surged in 2020 as COVID-19 lockdowns and safety concerns encouraged consumers to opt for direct delivery or click-and-collect solutions.

According to a study by integrated commerce company Mercatus, online grocery will account for 21.5% of total grocery sales by 2025, accelerating the anticipated pre-pandemic growth by 60%.

At the same time, shoppers are facing financial hardships not seen since the Great Depression. Those worst hit include working mothers who were forced to leave their jobs because of a lack of childcare and households that were already below the median income before the pandemic. These shoppers have turned to Ibotta because it’s the only at-scale platform that delivers cash back on item-level grocery purchases, doling out $195 million in 2020. By this spring, Ibotta is expected to have paid out a total of $1 billion, a milestone accelerated by meeting the moment with omnichannel solutions.

Omnichannel Challenges

The economic downturn and continued safety concerns have led shoppers to look for deals that they can easily access in-person, online, and via mobile apps. Shoppers with an Ibotta account are able to easily find deals while browsing on their desktop or mobile device from home or even in stores, where they search for item-level cashback deals.

Digital research company Insider Intelligence estimates that 44% of e-commerce purchases will be made on smartphones and tablets by 2024, making cross-platform solutions more important than ever for brands of all sizes.

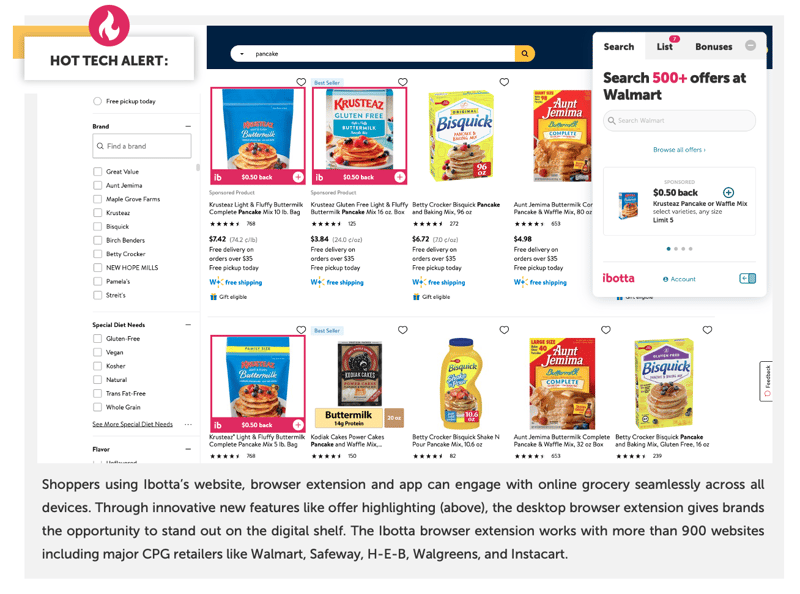

Ibotta’s omnichannel performance marketing tactics ensure CPGs only pay when a conversion is made online or in-store. Omnichannel brand campaigns deliver targeted content across every device including mobile, tablet, and desktop (below). CPGs with always-on Ibotta campaigns have access to real-time purchase insights and retargeting capabilities to optimize ROAS for their largest campaigns throughout the year.

Smart Marketing

As e-commerce adoption rises, brands are increasingly reconsidering their marketing mix to best reach consumers and maintain their loyalty. One of the clearest demonstrations of how COVID-19 has accelerated existing trends is the decision by Coca-Cola, PepsiCo, and Budweiser to skip advertising at the Super Bowl. While analyzing Super Bowl ads is a favorite pastime of marketers and casual football viewers, experts have been debating their value proposition for years as prices have surged, with a 30-second slot costing about $5 million in 2020.

Budweiser said it plans to use the money it would have normally spent on those spots to partner with the Ad Council on a COVID-19 vaccine awareness campaign while Coke said it’s focused on making sure it’s spending its ad money wisely. While a Super Bowl ad may have unbeatable reach, brands are increasingly turning to targeted, data-driven campaigns involving social, digital, and mobile solutions. A September report by the Interactive Advertising Bureau on COVID-19’s impact on advertising showed that spending on traditional TV ads plunged by 24% in 2020 while digital advertising increased by 6%. This coincided with a 10% increase in the amount of time consumers spent online in 2020.

TV spots aren’t the only legacy marketing tactic in decline. News Corp sold News America Marketing to a private equity firm last March. The search for a buyer began after the leading publisher of coupons in the U.S. saw an 8% decrease in year-over-year sales in 2019. The value proposition for in-store displays has also changed, with eMarketer predicting that it is likely to take five years for retailers to recover from the 14% decline in brick-and-mortar sales experienced during 2020, when e-commerce sales climbed to represent 14.5% of total retail purchases.

Customers will swap brands for convenience or out of necessity, so CPGs need to make sure that they aren’t losing sales to competitors by finding new ways to stand out on the digital shelf the same way they do in stores, with featured takeovers serving as the new in-store spectacular.

Marketing On Values

Budweiser’s choice to redirect funds to charitable efforts also reflects the brand meeting the moment. Charitable giving surged in 2020, exceeding levels seen in the 2008 recession or after the Sept. 11, 2001 terrorist attacks. Numerous brands and retailers have taken note, running campaigns showing shoppers they share their values.

In April 2020, Ibotta’s Earth Month event grabbed headlines by pointing out the amount of waste generated by paper coupons, coupled with their unsuitability for shoppers looking to reduce points of contact during the pandemic. Ibotta and 24 CPG brand partners helped people save money and the planet by donating over 1 million trees.

Ibotta continued to meet the needs of Americans by launching the Here to Help campaign in May, partnering with leading CPG brands to provide more than $10 million in cash back on essential items including personal care products and bread. Charitable efforts culminated in November with an extremely successful Free Thanksgiving Dinner promotion that fed over 3M Americans via $8M in free products and additional meals donated through Feeding America.

Omnichannel Sampling

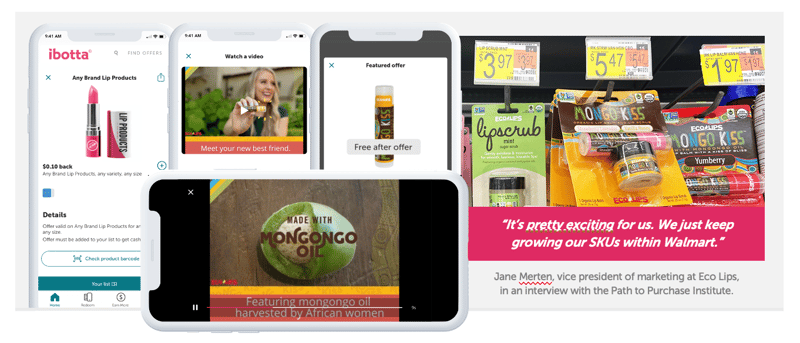

COVID-19 safety concerns will continue to disrupt experiential marketing and traditional sampling tactics. Brands pivoting into digital and mobile freebie programs now are driving the same benefits of sampling by letting consumers try products they’ll fall in love with. Recent examples include organic lip balm brand Eco Lips, which supported the launch of new SKUs at select Walmart stores with geo-targeted Ibotta offers and in-app media (below).

Kraft Heinz’s Philadelphia launched a new cheesecake crumble dessert for Valentine’s Day 2021 and offered Ibotta users a free trial. The sampling was part of a larger campaign featuring a sweepstakes awarding stressed out couples $150 to use for therapy. The brand’s marketing adaptability has paid off, contributing to a 6% increase in sales during the pandemic.

Returning to Normal

While the shifts to digital marketing and online grocery shopping are likely to last well beyond the end of the COVID-19 pandemic, the vaccine rollout means that late 2021 could bring a return to normal life. The back-to-school marketing season has traditionally been one of the biggest events for mass merchants and supermarkets selling everything from lunchbox essentials to clothes, and the 2021 season is likely to magnify that occasion by virtue of being the first time that many students will be returning to the classroom since March 2020.

CPG marketers should also consider a focus on Halloween 2021. The occasion once dominated by confectionery brands has grown to incorporate a huge number of categories from alcoholic beverages to pet treats and in 2021 it will likely provide one of the first excuses for a post-pandemic party along with a chance to safely go see a scary movie in the theaters.

Brands and retailers will need to meet shoppers where they are, combining digital strategies with more traditional in-store tactics as shoppers feel safe returning to brick-and-mortar locations. Those who can capitalize on pent-up demand for experiences while continuing to build on the e-commerce learnings from the heart of the pandemic will be in the best position to grow and maintain their omnichannel customer base.

Marketers today should know every dollar’s impact on growth.

- How many sales were driven?

- Which tactic drove the sale?

- Was the sale incremental?

- What should change to improve ROI?

If you’re not getting answers to these questions, let’s talk.

![]()

Achieve your brand goals

Which metrics are most important for your brand? Get in touch to explore possibilities with the Ibotta Performance Network.